bez-zatrat.ru

Prices

How To Spy On Someones Phone Free

Mobile Phone Tracker - hidden tracking app that secretly records location, SMS, call audio, WhatsApp, Facebook, Viber, camera, internet activity. phone spy,best free spy app,cell phone tracker,best spy app. How to Stop someone from Mirroring your Phone? MalwareFox•52K views. Qustodio is the top spy app with a free trial in Its blend of features, from web filtering to call monitoring, ensures parents have all the tools they. Phonsee is a spy app for Android that allows users to monitor the activity of a target phone without physically accessing it. With Phonsee. Snoopza — a very efficient cell phone spy app for Android. Cell phone spy app for Android allows you to spy on mobile free. Snoopza is the best assistant for. How to Track a Phone Without Them Knowing: 5 Easy Ways · 1. Install a Legitimate Phone Tracking App without Them Knowing · 2. Use the Scannero Phone Tracker. 1. Create your free account. It's as easy as entering your email. · 2. Pick your plan. Everyone's needs are different, so we've got multiple plans that work for. Free mobile tracking is so easy with Snoopza. Using it, you'll be able to find your lost or stolen gadget. It will take less than three minutes. At the same. Log into your risk-free account and select any device (Android, iPhone, PC, Mac or Chromebook) to monitor discretely from your secure online account. Mobile Phone Tracker - hidden tracking app that secretly records location, SMS, call audio, WhatsApp, Facebook, Viber, camera, internet activity. phone spy,best free spy app,cell phone tracker,best spy app. How to Stop someone from Mirroring your Phone? MalwareFox•52K views. Qustodio is the top spy app with a free trial in Its blend of features, from web filtering to call monitoring, ensures parents have all the tools they. Phonsee is a spy app for Android that allows users to monitor the activity of a target phone without physically accessing it. With Phonsee. Snoopza — a very efficient cell phone spy app for Android. Cell phone spy app for Android allows you to spy on mobile free. Snoopza is the best assistant for. How to Track a Phone Without Them Knowing: 5 Easy Ways · 1. Install a Legitimate Phone Tracking App without Them Knowing · 2. Use the Scannero Phone Tracker. 1. Create your free account. It's as easy as entering your email. · 2. Pick your plan. Everyone's needs are different, so we've got multiple plans that work for. Free mobile tracking is so easy with Snoopza. Using it, you'll be able to find your lost or stolen gadget. It will take less than three minutes. At the same. Log into your risk-free account and select any device (Android, iPhone, PC, Mac or Chromebook) to monitor discretely from your secure online account.

SpyHuman's FREE mobile spy app has been helping many parents for tracking their children's activities remotely for last couple of years. Many employers are. Some of the best apps for spying on someone's phone in include mSpy, Spyzie, and FlexiSPY. These apps offer a range of powerful monitoring. Completely free spy apps for parental control include Google Family Link, which offers basic monitoring and control over children's device usage. Looking for the best free spy phone tracker? You are at the right place. Spynger is one of the leading solutions for monitoring phones. Give it a try now! Just download and install the app on the phone you want to monitor. No credit card is required. Our phone monitoring app also offers GPS tracking for FREE. 1AirDroid Phone Monitoring App · 2mSpy Mobile Monitoring App · 3Mobile Tracker Free · 4uMobix · 5WebWatcher · 6KidsGuard Pro · 7Hoverwatch Free Mobile Monitor. Yes, XNSPY lets you see someone else's phone screen on your phone. It offers tools like screen recording and live screenshots that allow you to remotely capture. To access your phone activity, the person monitoring you signs in to a website or app on a different device. They may also receive notifications of certain. spy app on my phone? QUESTION. My partner and I separated about 9 months ago, he is in recovery from sex addiction and used his phone to "act. Learn how to use Spy99 to monitor someone's phone activity with ease! In this video, we'll guide you through installing and using Spy Unusual phone behavior, such as overheating when idle, weird sounds during calls, or increased data use, are signs that your phone is infected with spyware. Searqle is a free spy app that allows users to monitor someone's phone activities remotely. With Searqle, users can track text messages. Phone spy lets you see texts, photos, calls, website history, GPS & more Log into your risk-free account and select any device (Android, iPhone, PC. Hoverwatch: Free Android Spy will help you to monitor your kids. Call recording and phone tracking app for Android. Android market is full of tracking apps. If These Apps Are Still on Your Phone, Someone May Be Spying on You. Leah If you're OK with giving that up for some free services, that's a valid choice. Mobile Phone Tracker - hidden tracking app that secretly records location, SMS, call audio, WhatsApp, Facebook, Viber, camera, internet activity. Yes, some phone spy apps like ONEMONITAR, ONESPY and CHYLDMONITOR can be used to track someone's location without their knowledge. This spy phone app allows you to track android cell phone, whether you wish to oversee your children or your employees. dealing with someone "like this" is venomous. stay strong and remember to love and respect yourself. spy app on my phone? QUESTION. My partner and I separated about 9 months ago, he is in recovery from sex addiction and used his phone to "act.

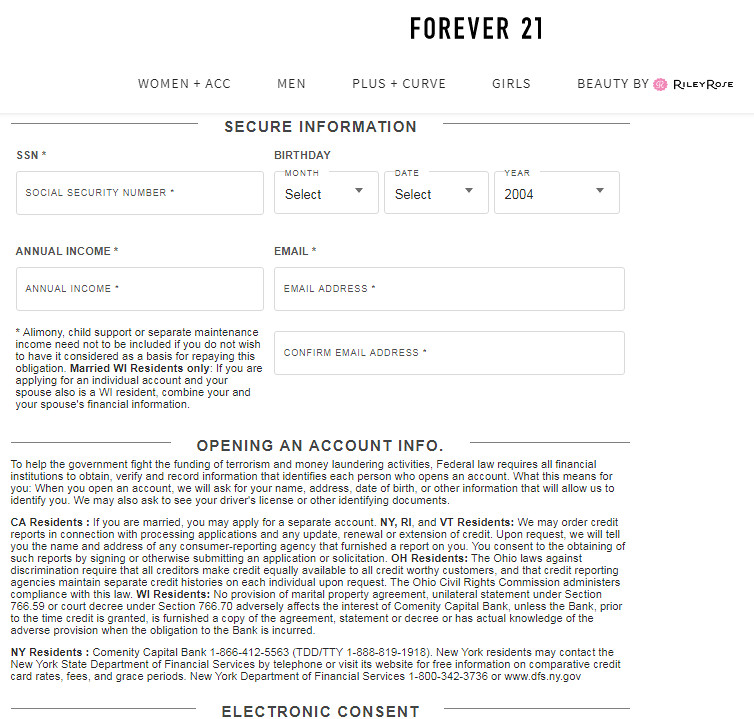

Forever 21 Make Payment

Use Zip to shop Forever 21, online or bez-zatrat.ru your payment into easy installments. Shop smarter! I really suggest calling your local forever 21 and confirming they do take Shein returns. Shein will issue a refund to your payment method. 20% off your first purchase when you open & use your Forever 21 Visa® Credit Card on the same day as account opening · $10 bonus reward when you use your Forever. Unless they begin using more unique designs or make deals with some of the designers they are “inspired” by, they will be forced to pay settlement after. For a small number of orders, it can take up to 24 hours. Next step. Gift Card Rewards Program. Average Forever 21 Store Manager hourly pay in the United States is approximately $, which is 7% below the national average. Salary information comes from. Pay your bill. View account activity. Check card balance. Update account information. FOREVER 21 CREDIT CARD · FOREVER 21 VISA CREDIT CARD. Enable Accessibility. Enable Accessibility. Help. Customer Service Track Order Shipping Info Online Returns & Exchanges Store Return & Exchange Contact Us. Forever 21 is the authority on fashion & the go-to retailer for the latest trends, styles & the hottest deals. Shop dresses, tops, tees, leggings & more! Use Zip to shop Forever 21, online or bez-zatrat.ru your payment into easy installments. Shop smarter! I really suggest calling your local forever 21 and confirming they do take Shein returns. Shein will issue a refund to your payment method. 20% off your first purchase when you open & use your Forever 21 Visa® Credit Card on the same day as account opening · $10 bonus reward when you use your Forever. Unless they begin using more unique designs or make deals with some of the designers they are “inspired” by, they will be forced to pay settlement after. For a small number of orders, it can take up to 24 hours. Next step. Gift Card Rewards Program. Average Forever 21 Store Manager hourly pay in the United States is approximately $, which is 7% below the national average. Salary information comes from. Pay your bill. View account activity. Check card balance. Update account information. FOREVER 21 CREDIT CARD · FOREVER 21 VISA CREDIT CARD. Enable Accessibility. Enable Accessibility. Help. Customer Service Track Order Shipping Info Online Returns & Exchanges Store Return & Exchange Contact Us. Forever 21 is the authority on fashion & the go-to retailer for the latest trends, styles & the hottest deals. Shop dresses, tops, tees, leggings & more!

f21xLeeJeans collection drops 7/31 online at forevercom + in-stores at select Forever 21! Forever Located near Target. W E B S I T E. forevercom. C O N T A C T. FIND ON MAP · Previous. Previous. Foot. Locker · Next. Next. This is my open letter to the Forever 21 near me. Please take the time to treat plus size people with the respect and dignity that you treat other. Forever 21 is growing quickly, featuring new and exciting store environments, a constant flow of fun and creative clothing designs and the accessories to make. We accept the following forms of payment for domestic US orders: Visa; Master; Discover; American Express; Paypal; Venmo; Klarna; Amazon Pay. Recommended Reviews - Forever Your trust is our top concern, so businesses can't pay to alter or remove their reviews. 21, Heritage , Reference or Gadzooks store in the U.S. and U.S. territories, or online. No returns and no refunds on gift cards. Product information. To pay Forever 21 Credit Card bill online, log in to your online account and find the payment button. Then, choose how much to pay, when to pay it, and where. How much does a Fashion Forever 21 make? As of Aug 19, , the average hourly pay for a Fashion Forever 21 in the United States is $ an hour. While. Send a loved one off on a shopping spree with a Forever 21 gift card. Buy one from the Kroger Family of Stores and earn fuel points. Payment for all goods must be made by credit or debit card. We accept payment with: Visa; MasterCard; American Express; Discover. How does Pay later in 4 interest-free installments work? What do I need to provide when I make a purchase? What happens to my statement, when I've returned. Forever 21 is the authority on fashion & the go-to retailer for the latest trends, styles & the hottest deals. Shop dresses, tops, tees, leggings & more! Forever 21 continues to be a fashion industry leader with a mission to make the latest trends accessible to all. F21 persists on staying ahead of innovation. Transunion. Making regular on-time payments to a creditor that reports to one or more credit bureaus will demonstrate your financial responsibility and may help. Welcome to the incredible world of Forever 21 – in your pocket and at your fingertips. Features: APP EXCLUSIVE OFFERS: Get exclusive access to sales and. Create an anonymous post and get feedback on your pay from other professionals. See how it works. These new store environments feature a constant flow of fun and creative clothing designs and accessories to make looks come together at the right price. A. Yes, you can do all of that with Share-A-Cart. No need for messy wishlist hacks; just add items to your cart at Forever 21 then send a code to your recipient. Make Up · Skincare · Beauty Tools + Brushes · Hair · The Gift Shop · Sale. Girls + And once you have your card, you can use it here at Forevercom. 1Subject.

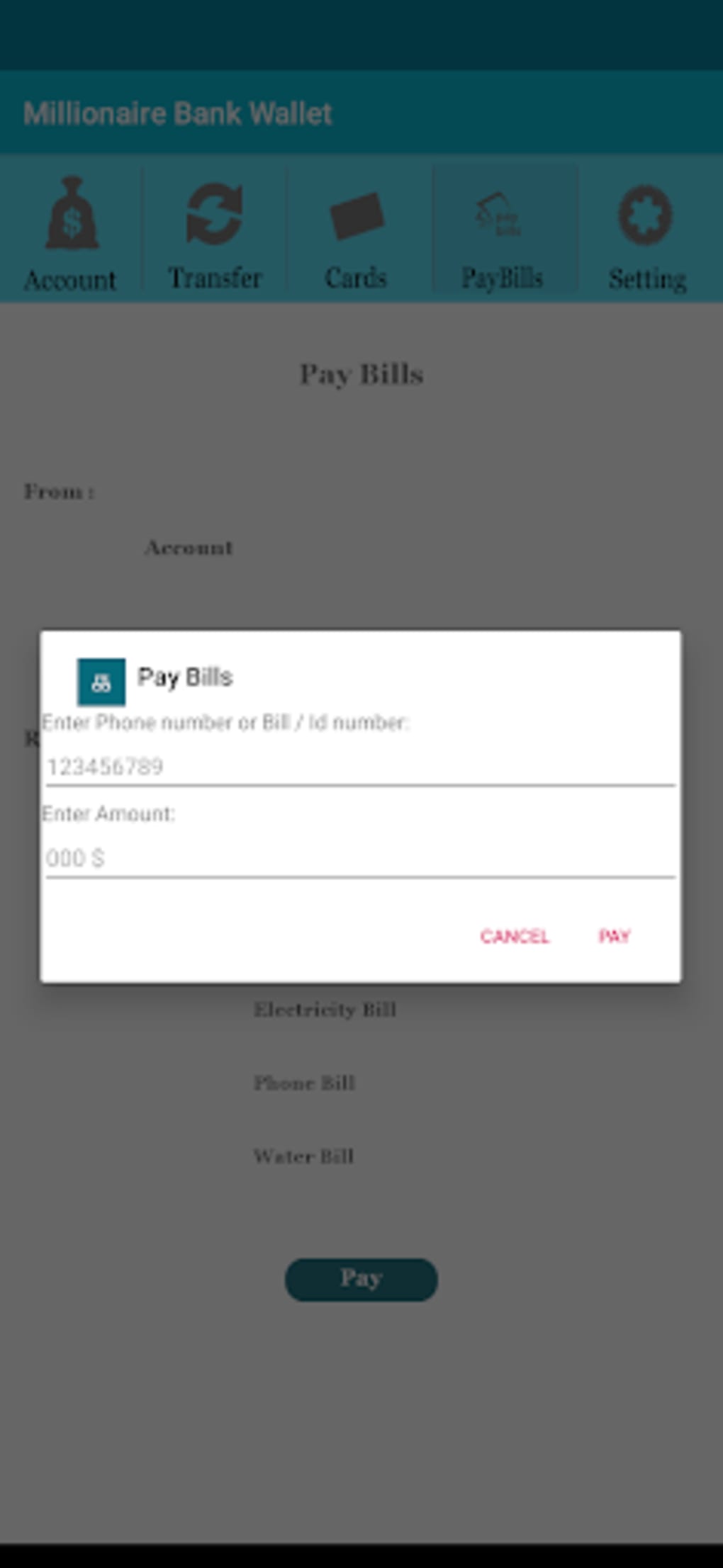

Spoof Bank Account

Contacted unexpectedly by phone, email, text, direct message or pop-up with a request for personal information or money. Bank of America will never text, email. If someone uses your SSN to obtain credit, loans, telephone accounts, or other goods and services, contact the Federal Trade Commission (FTC). The FTC collects. New account fraud occurs when a fraudster or money mule has been successfully onboarded by a financial institution after applying using their own identity. Report Financial Crimes and Fraudulent Activities. Contact the police or your local FBI office. Report Internet phishing to the Anti-phishing Working Group. Once the wire or cash transfer is done, the money is gone. A few times, Heritage Bank employees have noticed an elderly customer was transferring a large sum of. CFPB Takes Action Against Fifth Third for Wrongfully Triggering Auto Repossessions and Opening Fake Bank Accounts. Bank will pay consumer redress and is. This type of identity theft seeks to obtain online banking credentials or any other type of information that can be used to commit scams or fraud or to. The intention of a spoof website is usually to associate a scam with a reputable institution. Open a bank account · Mobile Banking via App · Talk to us. These are bank spoofing scams. The goal is to steal your money or private account access information like your PIN, password, or one-time access codes. Here are. Contacted unexpectedly by phone, email, text, direct message or pop-up with a request for personal information or money. Bank of America will never text, email. If someone uses your SSN to obtain credit, loans, telephone accounts, or other goods and services, contact the Federal Trade Commission (FTC). The FTC collects. New account fraud occurs when a fraudster or money mule has been successfully onboarded by a financial institution after applying using their own identity. Report Financial Crimes and Fraudulent Activities. Contact the police or your local FBI office. Report Internet phishing to the Anti-phishing Working Group. Once the wire or cash transfer is done, the money is gone. A few times, Heritage Bank employees have noticed an elderly customer was transferring a large sum of. CFPB Takes Action Against Fifth Third for Wrongfully Triggering Auto Repossessions and Opening Fake Bank Accounts. Bank will pay consumer redress and is. This type of identity theft seeks to obtain online banking credentials or any other type of information that can be used to commit scams or fraud or to. The intention of a spoof website is usually to associate a scam with a reputable institution. Open a bank account · Mobile Banking via App · Talk to us. These are bank spoofing scams. The goal is to steal your money or private account access information like your PIN, password, or one-time access codes. Here are.

If you suspect fraud, it's important to call us immediately at one of the phone numbers listed below: · Deposit Accounts: Debit Cards, Checks and Zelle®. If you're in doubt, call the client service number on our Contact Us page, on your statement or on the back of your credit, debit or ATM card. If you receive. Free checking (spending) account. Free ATMs, free first box of checks, zero Fraud Prevention Center · Financial Education · Financial Tips. Visit a. Combating Fraud · Savings and Money Market Accounts · Tower Savers - Child You may set up a traditional savings account or a money market account through. Learn about the most common bank scams and what form they take to ensure you stay safe. Never provide your personal information or money to someone if you. If you bank with Bank of Oklahoma, please notify us immediately. We'll work with you to help correct any unauthorized transactions in your Bank of Oklahoma. Scammers get access to your bank account numbers through fraudulent telemarketer calls or by stealing them from unsecured websites when you sign up for a free. You could get some large Amazon cardboard boxes and drawn them with crayon to look like a bank desk and so on. And then buy some fake money from. Bank Account Takeover · Phishing: Fraudsters create mass email or SMS campaigns that redirect users to a fake bank login page. · Social engineering: The ever-. With email spoofing, a scammer sends out an email where the address appears to come from a trusted entity. One popular email spoof tries to lure recipients to. The easiest way to become a victim of a bank scam is to share your banking info — e.g., account numbers, PIN codes, social security number — with someone you. The scammers intercept an email, change the bank details on the invoice and send it on for payment. In many cases, they use spoofing to make the email address. The fraudster will then use this information to remotely gain access to the victim's computer and ultimately their bank accounts. You may even see money. Bank account takeovers are often facilitated by cybercriminals using various methods like phishing, malware, social engineering, or exploiting. How Do Fraudsters Open Bank Accounts? · 1. They Create Synthetic Identities · 2. They Purchase Pre-Created Accounts · 3. They Spoof Their Configurations · 4. Smishing · You receive a fake text message, which may include a fraudulent link, asking you to register for an online service. · The scammer attempts to load a. Today's banking environment is full of scammers ready to take your money! Learn how to avoid common scams by reading more. Identity Theft · Phishing · Online. Very much a scam. Never, ever open a bank account for someone else in your name. It is illegal and any conduct performed on the account you are. For example, scammers can create phishing sites that look like your bank's login page or intercept your Wi-Fi network as you enter your credentials online. But.

Bank Accounts Offering Free Money

for checking accounts. Existing eligible Chase checking customers can refer a friend to bank with. Chase and earn a cash bonus. Open a Clear Access Banking account from this offer webpage and complete the qualifying requirementsOpens Dialog to receive your $ bonus. Get $ with our checking account bonus offer. Earn $ when opening an eligible Fifth Third checking account with qualifying activities. Find the checking account for you · Everything Checking Most popular account with perks like 55, free ATMs. · Free Checking Basic checking with no monthly fee. Get rewarded with the best free checking accounts, available at local banks and credit unions in your community. Open a free checking account today. Get that free money! I keep them mostly segregated from my primary bank accounts and close them when I'm done. Upvote 5. Downvote Award. Open an Everyday Checking account** with a minimum opening deposit of $25 from this offer webpage. Complete the qualifying requirements to receive your $ Transfer from your Bank of America checking or savings accounts; Mobile check deposit; ATM. This account does not offer external money transfers into the. Citibank: Earn a cash bonus of $ when you open an eligible checking account by Oct. 8, Deposit two enhanced direct deposits totaling at least $1, for checking accounts. Existing eligible Chase checking customers can refer a friend to bank with. Chase and earn a cash bonus. Open a Clear Access Banking account from this offer webpage and complete the qualifying requirementsOpens Dialog to receive your $ bonus. Get $ with our checking account bonus offer. Earn $ when opening an eligible Fifth Third checking account with qualifying activities. Find the checking account for you · Everything Checking Most popular account with perks like 55, free ATMs. · Free Checking Basic checking with no monthly fee. Get rewarded with the best free checking accounts, available at local banks and credit unions in your community. Open a free checking account today. Get that free money! I keep them mostly segregated from my primary bank accounts and close them when I'm done. Upvote 5. Downvote Award. Open an Everyday Checking account** with a minimum opening deposit of $25 from this offer webpage. Complete the qualifying requirements to receive your $ Transfer from your Bank of America checking or savings accounts; Mobile check deposit; ATM. This account does not offer external money transfers into the. Citibank: Earn a cash bonus of $ when you open an eligible checking account by Oct. 8, Deposit two enhanced direct deposits totaling at least $1,

account with a bank can offer you savings from check-cashing fees. Depositing checks is free in a bank. Paying bills can be cheaper without money orders. Checking Bonus: You will not qualify for the Checking Bonus if you are an existing TD Bank personal checking Customer OR had a previous personal checking. Frost Personal Account. 8 monthly service charge OR 0 with ways to waive. The essential account for feeling confident about your money. Fee-free online savings with one of the nation's top savings interest rates. %. APY. Variable APY | No fees or minimums. FDIC-. Start by opening a new eligible checking account today. See offer details. Erica is here for you, your life and your goals. M&T Bank offers several checking account options from interest bearing accounts and accounts with overdraft protection to checkless accounts. Free credit score. Opens in a new window · Financial Education Early direct deposit—with direct deposit, get your money up to two business days early. Open a new eligible Bank of America business checking account and qualify for a $ cash bonus offer · A business checking account gives you the tools you need. It's possible you'll receive part of the cash offer for opening the account, but have to sign up for automatic bill pay, direct deposit, or some other task to. Requirements: To qualify for a bonus, initially apply for a Discover Online Savings account using the Offer Code NW · When you'll get it: Bonus will be. SmartView Checking Account · Complimentary Money Market Savings account · Foreign ATM and surcharge fees rebated. · Free digital and mobile banking. · Earn interest. U.S. Bank offers as much as $ in cash when you open a new checking account. Here's how to qualify for a U.S. Bank welcome bonus. Rewards most commonly come in the form of free cash, though you may also be offered boosted rates on linked savings accounts or perks, such as free cinema. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Insurance Products are offered. Convenient access to the Allpoint ® nationwide network of ATM s—free of charge. That's more than what's offered by three leading banks combined. Bank on. New checking & savings customers can earn up to $ with qualifying activity. For new Customers only. Offer ends October 31, Then, they use the money to pay bills and spend as needed. Flagstar checking accounts offer many convenient ways to access your funds, including: Checks. Like many of its top competitors, TD Bank is currently offering a $50 checking account promotion, payable to both the referrer and the referred customer. This. A free checking account lets you safely and easily deposit and withdraw money for everyday purchases. You can use personal checks or a debit card to spend your. $0 Monthly Maintenance Fee for Bank Smartly ® checking accounts; Free cashier's checks*, personal money orders* and stop payments*; 50% discount on personal.

Manage Your Own Retirement Portfolio

Managing Retirement Wealth: An Expert Guide to Personal Portfolio Management in Good Times and Bad [Jason, Julie] on bez-zatrat.ru While we can't tell you how to manage your investment portfolio during a your own or with the help of a financial professional. There is no guarantee. 1. Set aside one year of cash · 2. Create a short-term reserve · 3. Invest the rest of your portfolio · Adapt your strategy over time. DIY investing. Manage your own investments (stocks, ETFs, mutual funds, CDs, and more), with help from our free resources. Enjoy all the benefits of having your IRA at Merrill · Determine your investor profile and manage your own retirement account or have it managed by Merrill. If you own multiple properties, you may need to consider how to manage your portfolio in retirement. Learn how to leverage your assets without being. This is an introduction to a self managed IRA and outlines the pros and cons of managing your own IRA. Figure out when you might have enough money to retire. · Learn about health care costs in retirement. · See how your retirement age affects your Social Security. Managing your own investment doesnt mean buying/selling random stocks. It just means, not paying a fee to a company to make very simple choices. Managing Retirement Wealth: An Expert Guide to Personal Portfolio Management in Good Times and Bad [Jason, Julie] on bez-zatrat.ru While we can't tell you how to manage your investment portfolio during a your own or with the help of a financial professional. There is no guarantee. 1. Set aside one year of cash · 2. Create a short-term reserve · 3. Invest the rest of your portfolio · Adapt your strategy over time. DIY investing. Manage your own investments (stocks, ETFs, mutual funds, CDs, and more), with help from our free resources. Enjoy all the benefits of having your IRA at Merrill · Determine your investor profile and manage your own retirement account or have it managed by Merrill. If you own multiple properties, you may need to consider how to manage your portfolio in retirement. Learn how to leverage your assets without being. This is an introduction to a self managed IRA and outlines the pros and cons of managing your own IRA. Figure out when you might have enough money to retire. · Learn about health care costs in retirement. · See how your retirement age affects your Social Security. Managing your own investment doesnt mean buying/selling random stocks. It just means, not paying a fee to a company to make very simple choices.

Our Automated Investing Account helps you build retirement wealth by blending our super-smart software with innovative opportunities like tech, clean energy. Types of individual retirement accounts · Rollover IRA. An option for money that you've saved in a former employer's workplace savings plan. · Roth IRA. Invest. It depends on your own unique retirement goals and other sources of savings. You might want to aim for your annual contribution from all sources — your own. Planning for retirement may feel overwhelming, but focusing on the levels of control you have over various factors can give you more confidence. 1. Review your asset allocation with new risks in mind. · 2. Prioritize your immediate cash needs. · 3. Don't abandon stocks. · 4. Prepare for volatility. Morningstar's K Retirement Manager SM can provide personalized advice on: · Portfolios typically need grooming several times a year. · Ready to learn more? · We. 8 Tips for Managing Your (k) · 1. Take Advantage of Your Employer Match · 2. Consider Your Circumstances Before Contributing the Max · 3. Understand Your (k). Managing your retirement portfolio allows you to be the lone decision maker for the assets you do and do not want to include in your portfolio. You alone are. The Discerning Investor gives you the tools to prepare for retirement on your own terms. Written by a lawyer who is now investment counsel, this book will. Quick guide to managing your retirement account online. When you enroll on W Personalize your model portfolio or opt out and choose your own investments. However, pensions are less common today. What this means for workers: You're in charge of your own retirement, so it's smart to take a proactive approach to. Or build your own retirement portfolio If you enjoy managing investments and want more control, you can determine your ideal asset mix and then choose. I am more hands-on than some, and prefer to manage my own portfolio. It's very clear, the controls for building and testing scenarios are excellent. I am able. Discover the various ways you can manage your path to retirement. Target date funds; My Total Retirement; Build your own portfolio. couple on couch, checking. And while it's difficult to eliminate investment risk, you may be able to manage it by having a diversified investment portfolio. Your asset allocation. Building your retirement investment portfolio. Don't let investing your Build your retirement budget so that you can better manage your financial well-being. Maximize your enjoyment of retirement; Manage the risk of outliving your income; Manage the risk of unexpected life events and investment risk. The difference. Retirement Accounts · Already retired? Learn more about · Tax Advantages. · Control. · Fees. · Contribution Limits. · Catch-Up Contributions. · Matching Contributions. From (k) planners to IRA calculators, our retirement tools can help you run the numbers, compare tax implications and estimate your balance at retirement. Target date funds and the option to employ the services of a professional management program allow peace of mind for those who prefer to be less involved with.

Setting Up A Trust In Your Will

An irrevocable trust is a trust that you create during your lifetime but that you relinquish the power to modify. A testamentary trust is a trust that is. That is because a will requires no action on your part after it is signed and is simpler to create than a trust. On the other hand, a revocable trust is more. Establishing a trust requires a document that specifies your wishes, lists beneficiaries, names a trustee or trustees to manage the assets, and describes what. Estate planning through a trust can provide peace of mind that your assets will be protected and distributed according to your wishes. While establishing a. To create a testamentary trust in a will, the testator, who is also the grantor of the trust, must designate a trustee and specify the beneficiaries. The. The trustee can be yourself, but when you are no longer able to handle your affairs or upon you passing, you will need to have named a successor trustee to take. 3. Trusts offer specific parameters for the use of your assets Whether you establish a trust under your will and/or create a separate trust agreement during. A living trust keeps these assets safe until they transfer to your beneficiaries. This overview explains living trusts, how to create them, and why you may want. A Trust is a legal fiduciary arrangement that allows you to set up your assets to be held and managed by a third party. An irrevocable trust is a trust that you create during your lifetime but that you relinquish the power to modify. A testamentary trust is a trust that is. That is because a will requires no action on your part after it is signed and is simpler to create than a trust. On the other hand, a revocable trust is more. Establishing a trust requires a document that specifies your wishes, lists beneficiaries, names a trustee or trustees to manage the assets, and describes what. Estate planning through a trust can provide peace of mind that your assets will be protected and distributed according to your wishes. While establishing a. To create a testamentary trust in a will, the testator, who is also the grantor of the trust, must designate a trustee and specify the beneficiaries. The. The trustee can be yourself, but when you are no longer able to handle your affairs or upon you passing, you will need to have named a successor trustee to take. 3. Trusts offer specific parameters for the use of your assets Whether you establish a trust under your will and/or create a separate trust agreement during. A living trust keeps these assets safe until they transfer to your beneficiaries. This overview explains living trusts, how to create them, and why you may want. A Trust is a legal fiduciary arrangement that allows you to set up your assets to be held and managed by a third party.

This is referred to as a testamentary trust. This type of trust does not go into effect until the testator's death. Other trusts are set up during the lifetime. A trust is different from a will, which is what most people think of when it comes to estate planning. A will is a legal document that lays out your wishes for. your lifetime. As an essential part of setting up your trust, you will need to transfer (that is, retitle) your assets into the name of your revocable trust. To create a trust, the trust maker (usually called the settlor or grantor in the trust document) transfers legal ownership of his or her property to a person or. Step 1: Draft a Trust document. A Trust Agreement document simply lists all assets and names all beneficiaries associated with the Trust. Of course, for a. The main takeaway is that a living trust becomes active from the moment it is created. The grantor can distribute property and other assets before their passing. But, even though your will can provide for information on how to distribute your However, be aware that not every person offering to set up a trust is. A will can contain wording to create a testamentary trust to save estate taxes, care for minors, etc. But because it's part of your will, this trust cannot go. Trusts are used to distribute assets and don't have to go through probate like a Will. Make a Will, Trust or other estate planning documents. A testamentary trust is a trust that is to contain a portion or all of a decedent's assets outlined within a person's last will and testament. A testamentary. If you create a revocable trust, you will need to choose a Trustee and decide how the property will be managed after you die. If you want to avoid probate, you. A Trust can be set up during a person's lifetime or on their death, whereas, a Will won't be activated until the person dies. A Will is a document that. Since the assets in a trust do not have to go through probate, it can be a much quicker and easier way to transfer wealth to your heirs. Also, some trusts . Trusts are a common way to manage more complex estate planning. A revocable trust, also known as a living trust, can be created by an individual or jointly by a. If you establish a trust but fail to transfer your assets to your trustee, it is unlikely that you will avoid probate. If you die owning real estate outside. To set up a trust, choose the type, list your assets, and select a trustee. The trust document will need to be notarized before you can transfer assets into it. Setting up a trust does not eliminate the need for a will in your estate plan. Why? Because a trust rarely ever includes all of your assets, and a will serves. When you set up a revocable living trust, you generally have a few choices to make about who will serve as trustee when you're gone. It's an important role. When Can A Will Trust Be Set Up? You can write a will trust into your Will, to take effect after you die. There's is usually a gap between the date of death.

2 3 4 5 6