bez-zatrat.ru

News

What Is Current Mortgage Loan Rate

Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. Customized mortgage rates ; 7/6 ARM, % (%), $3, ; year fixed, % (%), $ ; year fixed, % (%), $39 ; year fixed, % . Today's mortgage rates · Today's year fixed mortgage rates. % Rate. %. ** 3-year fixed-to-adjustable rate: Initial % (% APR) is fixed for 3 years, then adjusts annually based on an index and margin. For a year loan of. Here are today's mortgage rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. We've compiled a list of today's average mortgage and refinance interest rates below. Start here and compare the best mortgage rates you can qualify for today. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 2 basis points from % to % on Saturday. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. Today's competitive mortgage rates ; year fixed · % ; year fixed · % ; 5y/6m ARM · %. Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. Customized mortgage rates ; 7/6 ARM, % (%), $3, ; year fixed, % (%), $ ; year fixed, % (%), $39 ; year fixed, % . Today's mortgage rates · Today's year fixed mortgage rates. % Rate. %. ** 3-year fixed-to-adjustable rate: Initial % (% APR) is fixed for 3 years, then adjusts annually based on an index and margin. For a year loan of. Here are today's mortgage rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score. We've compiled a list of today's average mortgage and refinance interest rates below. Start here and compare the best mortgage rates you can qualify for today. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 2 basis points from % to % on Saturday. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. Today's competitive mortgage rates ; year fixed · % ; year fixed · % ; 5y/6m ARM · %.

Current Rates: Mortgage Purchase Rates, Mortgage Refi Rates, Vehicle Loans Rates, Personal Loans Rates, Home Equity Rates, Student Loans Rates, Credit Cards. New home purchase ; year fixed mortgage · % ; year fixed mortgage · % ; year fixed mortgage · % ; % first-time-homebuyer · %. Mortgage Home Loan Rates · Year Fixed. Interest Rate. %. Annual Percentage Rate (APR) · 15/15 Year Adjustable Rate Mortgage. Interest Rate. %. Current Mortgage Rates ; % · %. 15 Year Fixed Rate · %. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. Results will show you a snapshot of mortgage rates and corresponding annual percentage rate (APR) for competitive programs that PNC offers. Compare today's mortgage rates. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of September. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Current Mortgage Purchase Rates ; Yr FHA · %, %, % ; Yr VA · %, %, %. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Daily Rate Sheet ; 10 Year Fixed, %, % ; 15 Year Fixed, %, % ; 20 Year Fixed, %, % ; 30 Year Fixed, %, %. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. Explore today's mortgage rates and compare home loan options. When you're ready to apply, call Navy Federal at and get pre-approved for a. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $2, The national average mortgage rate is %. Find out what your personal rate could be. Check our rates. National average rates. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. New home purchase ; year fixed mortgage · % ; year fixed mortgage · % ; year fixed mortgage · % ; % first-time-homebuyer · %.

Retirement In Costa Rica Requirements

Requirements of the Costa Rica Residence by Investment Program · Investor Residency category. Applicants must invest USD , into one of the following. Pensionado is the most popular among retirees, for which proof of a minimum income of USD 1, per month from a qualified retirement account or pension is. Applicants need to demonstrate a minimum income of $1, per month from sources such as a pension, business, fixed retirement plan, or Social Security. IRAs do. Living in Costa Rica does require a little more patience and calm understanding of the culture. Why rush, sit back enjoy and don't stress you might live. Health and happiness rely on some key factors and retirement in Costa Rica might be what you've been dreaming about your whole life · 1. It has affordable real. Rentista & Pensionado Income Proof Requirements. Both income based statuses require you to deposit your income in a Costa Rican bank – $12, per year for. Whether you're the type to plan every last detail or to entrust the details to fate, retiring and relocating abroad will require at least some advance planning. What is the Costa Rica retirement visa (Pensionado visa) and what are the requirements? The Pensionado visa is a program for retirees in Costa Rica. It offers. The only heavy requirement to get a pensionado visa status here is to prove an income of $1, coming from a permanent source, even for couples. This could be. Requirements of the Costa Rica Residence by Investment Program · Investor Residency category. Applicants must invest USD , into one of the following. Pensionado is the most popular among retirees, for which proof of a minimum income of USD 1, per month from a qualified retirement account or pension is. Applicants need to demonstrate a minimum income of $1, per month from sources such as a pension, business, fixed retirement plan, or Social Security. IRAs do. Living in Costa Rica does require a little more patience and calm understanding of the culture. Why rush, sit back enjoy and don't stress you might live. Health and happiness rely on some key factors and retirement in Costa Rica might be what you've been dreaming about your whole life · 1. It has affordable real. Rentista & Pensionado Income Proof Requirements. Both income based statuses require you to deposit your income in a Costa Rican bank – $12, per year for. Whether you're the type to plan every last detail or to entrust the details to fate, retiring and relocating abroad will require at least some advance planning. What is the Costa Rica retirement visa (Pensionado visa) and what are the requirements? The Pensionado visa is a program for retirees in Costa Rica. It offers. The only heavy requirement to get a pensionado visa status here is to prove an income of $1, coming from a permanent source, even for couples. This could be.

Retirees are eligible to apply for permanent residency under Costa Rica's Pensionado program, provided that they have a minimum income of $1, from a lifelong. Many retirees wonder what it costs to live comfortably in Costa Rica. As a general guideline, we recommend that people moving here from the States, Canada, and. You would do fine in the Philippines, especially outside of Manila, on $ per month. The pluses are good, long-term visas for retirees. Main requirement: Proof of at least US$ monthly from lifetime pension fund or retirement fund. Key document: Income Certification. 2. Costa Rica. To retire in Costa Rica, you'll need a pension with a minimum monthly income of $1, USD. This amount can be sourced from Social Security or any private. Countries that offer retirement visas of one form or another include Costa Rica Retirement Visa Requirements. Retirement visas go by different names in. The applicant must prove a permanent (life) fixed monthly income from either a pension or other form of retirement income of at least US$1,, legal tender. Costa Rica offers a number of visa options for retirees including the pensionado visa, which is available to individuals who can prove a steady monthly income. If you wish to stay longer than three months, you must apply for a temporary residence permit. Moving to Costa Rica for Retirement. To retire in costa Rica, you. People who can prove a minimum pension income or savings can easily retire to Costa Rica. Costa Rica Visa Requirements. There are many options for visas. Costa Rica Rentista (Renter) Visa Suited for expats and retirees without a fixed pension income. Applicants need to obtain a document from a bank or financial. The essential requirement for applying as a rentier ('rentista') resident is that the applicant, including their family group (either spouse or partner, parents. What Are the Legal Requirements For Residency in Costa Rica? · Pensionado Residency Source of Income · Rentista Residency Source of Income · Inversionista. Income Requirement. Must show proof of monthly income from a qualified pension plan of at least $1, USD per month. A pension plan can include. Retiring in Costa Rica: Applying for a Residence · Pensionado Program. · The Rentista Program is intended for people ineligible for the Pensionado program but who. Ease of residency – Costa Rica offers multiple residency options that can provide potential benefits, such as tax exemptions, to retirees. Its “golden visa”. The Costa Rican government grants temporary residency to retirees via the visa process at the Embassy of Costa Rica. Applicants must provide proof of earning a. Proof of monthly income of at least US$2, (for two years); US$60, in a Costa Rican bank; For visa renewal, you must have lived in Costa Rica for four. What are eligibility requirements for the Pension "pensionado" Visa? · You need a passport valid for at least 6 months. · You should be of good conduct. · You need. Requirements for Pensionado Residency · Proof of a permanent pension or retirement fund providing a monthly income of at least $1, USD. · Reside in Costa Rica.

Chase Checkbook

Use Chase Direct Deposit to save time by depositing your paycheck directly to your account. Download a direct deposit form now! Manage your account, pay your bills, deposit checks and transfer money in the Chase Mobile app Check out our bank account without overdraft fees. View. The app sends me to the bez-zatrat.ru website to order the checkbook. I've tried ordering them in December, they never came. It's typical for personal checks to expire after six months. This time frame is laid out in the Uniform Commercial Code (UCC), a set of laws that govern. About this Item. Title. Salmon P. Chase Papers: Financial Papers, ; Checkbook and canceled checks, Names. Chase, Salmon P. (Salmon Portland). A duplicate check is a copy of a standard check. It has the same check number and other information as the original and is usually made through a carbon paper. Customers who want to order checks online should first log in to their accounts on Chase's website. Once you have access to your account, click on “More ”. Chase Checks Marketplace, Custom Business Cheques, Deposit slips - Customize and order now. Our Traveller business checks are full-sized, yet easily carried in your purse, briefcase or pocket! An ideal full-size business check for organizations. Use Chase Direct Deposit to save time by depositing your paycheck directly to your account. Download a direct deposit form now! Manage your account, pay your bills, deposit checks and transfer money in the Chase Mobile app Check out our bank account without overdraft fees. View. The app sends me to the bez-zatrat.ru website to order the checkbook. I've tried ordering them in December, they never came. It's typical for personal checks to expire after six months. This time frame is laid out in the Uniform Commercial Code (UCC), a set of laws that govern. About this Item. Title. Salmon P. Chase Papers: Financial Papers, ; Checkbook and canceled checks, Names. Chase, Salmon P. (Salmon Portland). A duplicate check is a copy of a standard check. It has the same check number and other information as the original and is usually made through a carbon paper. Customers who want to order checks online should first log in to their accounts on Chase's website. Once you have access to your account, click on “More ”. Chase Checks Marketplace, Custom Business Cheques, Deposit slips - Customize and order now. Our Traveller business checks are full-sized, yet easily carried in your purse, briefcase or pocket! An ideal full-size business check for organizations.

• Chase exclusive design checks when ordered through Chase (effective November 17,. , fees will apply for these checks). Fees may apply for certain other. Make a transaction at a Chase branch. Claim uncashed official bank checks issued on First Republic: All bank drafts (such as official checks, cashier's checks. 20 Pack Checkbook Register, Check Registers for Personal, Blank Ledger Transaction Registers for Personal or Business Bank, Check Register Book for Checking. Deposited Item returned or Cashed Check returned. Money orders and cashier's checks. Legal processing.¹. Chase Overdraft fees. View images of checks you've written for up to three years online when you sign in to your account on bez-zatrat.ru Checkbook's platform can be leveraged by J.P. Morgan clients to issue digital checks All rights reserved. © JPMorgan Chase & Co. Member FDIC. Deposits. Open the Chase Bank statement PDF using a PDF reader on your computer. 2. Click on the "Fill & Sign" option usually located on the top right corner of the PDF. It's typical for personal checks to expire after six months. This time frame is laid out in the Uniform Commercial Code (UCC), a set of laws that govern. We can personaliz any manual business check with your banking information from Chase, such as routing number, account number, and bank address. You write paper checks, withdraw money from an automated teller machine (ATM), or pay with a check card. Your paycheck might go by "direct deposit" into your. Routing and account number information is easily available for Chase customers. You can consult our app, go online, or locate the numbers on your checks. If you are looking for free Chase checks, OnlineCheckWriter will be the better choice. Chase checks can print at your home or office using. Make sure your checkbook register is up to date with all transactions, whether they are on your statement or not. Don't forget to include debit card. All Years. ; ; ; ; ; ; ; ; ; ; ; All Years. Spending Summary · Checkbook. JP MORGAN CHASE BANK broken down by Payee. You also can get free "counter checks" at a Chase branch, walk to a counter and ask for it, they'll print them for you right there. Chase offers a convenient way to order new ones directly from their online banking platform. Here's a guide to navigating the process. You CAN deposit the check of California and Trust Bank into a Chase Bank account if you have a checking and/or savings account with Chase Bank. An eCheck, or electronic check, is a digital version of a traditional paper check. WIth an eCheck, money is electronically withdrawn from the payer's checking. Order checks quickly, easily, and at member-only prices with additional savings for Costco. Executive Members. Get secure, customized personal or business. Chase Checks. $ Image of Chase Checks. Small, Medium, Large, XL, XXL, 3X, 4x - $ Add to Cart. 0 items $ Shop. All Products. Search.

Lytix

Stock LYTIX BIOPHARMA AS Common Stock NO MERK Euronext Growth Oslo Live Euronext quotes, realtime prices, charts and regulated news. LYTIX Price Targets Summary. Lytix Biopharma AS. Wall Street analysts forecast LYTIX stock price to rise over the next 12 months. According to Wall Street. Lytix brings insights, testing, and E2E analytics to your LLM stack with minimal changes to your existing codebase. Product insights & monitoring. Lytix Biopharma. LYTIX. Unlock. Watching. Analyst Stock Pitch · Updates · Profile · Estimates · Financials · New. Ownership · Disclosures. Redeye Insights. The company's products comprise of LTX, an oncolytic molecule for targeting deep-seated lesions, such as liver cancer and is in a preclinical phase. Lytix. Complete Lytix Biopharma A/S stock information by Barron's. View real-time LYTIX stock price and news, along with industry-best analysis. Lytix Biopharma ASA, a clinical stage biotech company, develops novel cancer immunotherapies for cancer therapy in Norway. Its lead product candidate is. Research. Date range: 1 May - 30 April No articles found. Lytix Biopharma AS did not contribute to any. Lytix Biopharma AS engages in the development of novel drugs for the treatment of resistant bacterial and fungal infections, as well as oncology treatments. The. Stock LYTIX BIOPHARMA AS Common Stock NO MERK Euronext Growth Oslo Live Euronext quotes, realtime prices, charts and regulated news. LYTIX Price Targets Summary. Lytix Biopharma AS. Wall Street analysts forecast LYTIX stock price to rise over the next 12 months. According to Wall Street. Lytix brings insights, testing, and E2E analytics to your LLM stack with minimal changes to your existing codebase. Product insights & monitoring. Lytix Biopharma. LYTIX. Unlock. Watching. Analyst Stock Pitch · Updates · Profile · Estimates · Financials · New. Ownership · Disclosures. Redeye Insights. The company's products comprise of LTX, an oncolytic molecule for targeting deep-seated lesions, such as liver cancer and is in a preclinical phase. Lytix. Complete Lytix Biopharma A/S stock information by Barron's. View real-time LYTIX stock price and news, along with industry-best analysis. Lytix Biopharma ASA, a clinical stage biotech company, develops novel cancer immunotherapies for cancer therapy in Norway. Its lead product candidate is. Research. Date range: 1 May - 30 April No articles found. Lytix Biopharma AS did not contribute to any. Lytix Biopharma AS engages in the development of novel drugs for the treatment of resistant bacterial and fungal infections, as well as oncology treatments. The.

Complete Lytix Biopharma A/S stock information by Barron's. View real-time LYTIX stock price and news, along with industry-best analysis. Discover historical prices for bez-zatrat.ru stock on Yahoo Finance. View daily, weekly or monthly format back to when Lytix Biopharma AS stock was issued. Lytix Biopharma AS operates as a clinical stage biotech company. The Company focuses on developing novel cancer immunotherapies based on tumor infiltrating. Lytix Biopharma is a pharmaceutical company specializing in anti-microbials and cancer therapeutics. Lytix Biopharma is a clinical-stage biotech company with a highly novel technology platform using host-defense peptide-derived molecules to kill cancer. Traders use it to see if the asset is oversold or overbought. We've counted how many oscillators show the neutral, sell, and buy trends for LYTIX BIOPHARMA AS —. Lytix Biopharma is a pharmaceutical company specializing in anti-microbials and cancer therapeutics. LYTIX BIOPHARMA NK -,10 share price in real-time (A3CSAK / NO), charts and analyses, news, key data, turnovers, company data. Discover historical prices for bez-zatrat.ru stock on Yahoo Finance. View daily, weekly or monthly format back to when Lytix Biopharma AS stock was issued. Lytix Biopharma AS is a clinical-stage biotech company engaged in developing cancer immunotherapies aimed at activating the patient's immune system to fight. So LYTIX BIOPHARMA AS technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a. Oslo, Norway, 25 April Reference is made to the stock exchange announcements published by Lytix Biopharma AS ("Lytix" or the "Company") earlier today, on. Lytix provides business intelligence and analytics services. Lytix Biopharma is a clinical stage biotech company developing a novel class of cancer immunotherapy, an area within cancer therapy that is aimed at activating. Lytix. likes · 3 talking about this. IT consultancy firm specialized in Microsoft Analytics. • Datawarehousing & BI • Self-Service Analytics • Big. This firm specializes in Microsoft Analytics, Datawarehousing & BI, Self-Service Analytics, Big Data & IoT, and Advanced Analytics. Founded in , Lytix. View the Lytix (LYTX) price live in US dollar (USD). Today's value and price history. Discover info about market cap, trading volume and supply. Lytix Biopharma. LYTIX. Unlock. Watching. Analyst Stock Pitch · Updates · Profile · Estimates · Financials · New. Ownership · Disclosures. Redeye Insights. Information on valuation, funding, cap tables, investors, and executives for Lytix (Consulting Services). Use the PitchBook Platform to explore the full.

Nasdaq 100 Vs Sp 500

By the close of , the Nasdaq surged by 55% on a total return basis, markedly surpassing the S&P 's 26% increase. This impressive performance is. The S&P is the weighted index of the market cap of the largest publicly traded companies in the United States. The index includes many companies in the. NASDAQ in general has a higher market beta than the S&P , so in theory you should be rewarded with higher returns because you're taking. %. ^IXIC NASDAQ Composite. 16, %. ^NYA NYSE COMPOSITE (DJ). 18, %. ^XAX NYSE AMEX COMPOSITE INDEX. 4, %. ^BUKP Cboe. The Nasdaq® Index comprises the largest non-financial companies traded on the Nasdaq. An investor cannot invest directly in an index. Diversification. The three indices used most in the U.S. are the Nasdaq Composite Index, the Dow Jones Industrial Average and the S&P Index. of them compared to the. The Nasdaq Composite and the S&P cover more sectors and have more stocks in their portfolios compared to the Dow, which is a blue-chip index of 30 stocks. The Nasdaq Total Return Index has outperformed the S&P in 12 out of the 16 calendar years in our study, resulting in an impressive average return of +. The tables below show the average returns of the Nasdaq and S&P indexes over the last periods. By the close of , the Nasdaq surged by 55% on a total return basis, markedly surpassing the S&P 's 26% increase. This impressive performance is. The S&P is the weighted index of the market cap of the largest publicly traded companies in the United States. The index includes many companies in the. NASDAQ in general has a higher market beta than the S&P , so in theory you should be rewarded with higher returns because you're taking. %. ^IXIC NASDAQ Composite. 16, %. ^NYA NYSE COMPOSITE (DJ). 18, %. ^XAX NYSE AMEX COMPOSITE INDEX. 4, %. ^BUKP Cboe. The Nasdaq® Index comprises the largest non-financial companies traded on the Nasdaq. An investor cannot invest directly in an index. Diversification. The three indices used most in the U.S. are the Nasdaq Composite Index, the Dow Jones Industrial Average and the S&P Index. of them compared to the. The Nasdaq Composite and the S&P cover more sectors and have more stocks in their portfolios compared to the Dow, which is a blue-chip index of 30 stocks. The Nasdaq Total Return Index has outperformed the S&P in 12 out of the 16 calendar years in our study, resulting in an impressive average return of +. The tables below show the average returns of the Nasdaq and S&P indexes over the last periods.

Summary ; S&P , %, %, ; Nasdaq, %, %, The Nasdaq and S&P are two of the most popular equity indexes in the US. The Nasdaq is heavily allocated towards top performing industries such. $ Minimum additional investment ($). $ Inception date. December 18, Category (CIFSC). U.S. Equity. Benchmark. Nasdaq Index (TR C$). Total. I have the IShares Nasdaq tracker and he has done very well. Far better than S&P Growth for me is comparable to the likes of SMT. I think that from now. Despite the sharp drop in the market from October to December , the Nasdaq still outperformed S&P by 4% in and by 3% in the first half of S&P and Nasdaq closed at fresh ATH today BUT Nasdaq (NDX) vs S&P (SPX) hit an ATH as well w/Nasdaq has consistently. E-mini S&P ESG Index Futures · E-mini S&P Equal Weight · E-mini S&P E-mini Nasdaq futures contract vs FANGS. Launch lesson. 4 modules. The Nasdaq to S&P ratio is a financial metric that compares the performance of the Nasdaq Composite Index, which primarily consists of technology and. The index includes leading companies in leading industries of the U.S. economy, which are publicly held on either the NYSE or NASDAQ, and covers 75% of U.S. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. However, the. Nasdaq bounced back over the first quarter of , outperforming the S&P by a margin of. % as Technology and Growth-related stocks. When the ratio rises, it indicates that the Nasdaq is outperforming the S&P , suggesting that technology and growth stocks are experiencing stronger growth. Since January 1, , the Nasdaq Index has delivered a cumulative total return of %, more than double the % return of the S&P Index.2 In turn. Nasdaq has significantly outperformed S&P in terms of performance. Over the past 15 years, Nasdaq has delivered a CAGR of around 16%. By measuring these stocks collectively, indices track how the overall market is performing better than only looking at the performance of a single stock. The weights are: % three-year rating for months of total returns, 60% five-year rating/40% three-year rating for months of total returns, and Tom ; wrote: The FTSE is outperforming the S&P since the bubble burst in late The main gain for US investors has been the falling GBP v. searchCompare to. Dow Jones Industrial Average. 40,DJI %. Nasdaq 18, NDX %. Nasdaq Composite. 16,IXIC %. S&P/TSX. It can occur on the upside, too! Here are some charts and tables with historical volatility and returns on the Nasdaq vs the S&P. Annual Volatility. Goldman Sachs projects the S&P to reach 4, by year-end , as noted by David Kostin and his team in a recent day client brief. This.

Best Online Lending Services

Voted Best Personal Loan of by NerdWallet. Consolidate debt and pay for life's expenses with same day online personal loans from SoFi. Apply online! Personal Loan Services Available 24/7. We can customize an Applying for an ECA loan is easy through FCU Anywhere online banking or mobile app. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. I'm looking for advice on finding a loan that's accessible even with bad credit. Can anyone recommend reliable payday loan service? A couple searching for the best online loan for bad credit. Bad Credit Loan The online service will set the loan's rates and terms for the lender or investor. See why Discover's a great choice · Citibank Personal Loan · LendingClub · SoFi · Wells Fargo Personal Loans · Prosper Funding · Upstart. Make the most of your money with LendingClub, recently awarded Best Online Bank for by GOBankingRates. Our superior products and services are built to. Prosper is among the first peer-to-peer lending programs available in the U.S. Since launching in , it has funded over $23 billion in loans and helped over. Make the most of your money with LendingClub, recently awarded Best Online Bank for by GOBankingRates. Our superior products and services are built to. Voted Best Personal Loan of by NerdWallet. Consolidate debt and pay for life's expenses with same day online personal loans from SoFi. Apply online! Personal Loan Services Available 24/7. We can customize an Applying for an ECA loan is easy through FCU Anywhere online banking or mobile app. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. I'm looking for advice on finding a loan that's accessible even with bad credit. Can anyone recommend reliable payday loan service? A couple searching for the best online loan for bad credit. Bad Credit Loan The online service will set the loan's rates and terms for the lender or investor. See why Discover's a great choice · Citibank Personal Loan · LendingClub · SoFi · Wells Fargo Personal Loans · Prosper Funding · Upstart. Make the most of your money with LendingClub, recently awarded Best Online Bank for by GOBankingRates. Our superior products and services are built to. Prosper is among the first peer-to-peer lending programs available in the U.S. Since launching in , it has funded over $23 billion in loans and helped over. Make the most of your money with LendingClub, recently awarded Best Online Bank for by GOBankingRates. Our superior products and services are built to.

Best for home improvement: LightStream. Why LightStream stands out: LightStream — the online lending division of Truist Bank — offers personal loans ranging. Borrow money ASAP and on your own terms with an online loan from bez-zatrat.ru RISE offers flexible terms, free credit monitoring and a 5-day risk-free. Personal loans from Wells Fargo are a great way to manage debt, fund special purchases, or cover major expenses. Apply online Customer Service · About Us. An online personal loan for you—secure, long-term, and funded as soon as the next business day. Top picks from our partners · Best for Large Amounts: SoFi · Best for Debt Consolidation: Happy Money · Best for Small Amounts: Upgrade. LoanNow offers quick installment loans. It's the fastest and easiest way to borrow, and you could even build your credit history as you repay. We take great pride in providing the best customer service around by carefully listening to your needs and eliminating the worry of obtaining credit. Compare personal loan rates from top lenders for September ; LightStream · · Loan term. 2 - 7 years ; Upstart · · Loan term. 3, 5 years. LightStream online lending offers loans for auto, home improvement and practically anything else, at low rates for those with good credit. America's Best Online Lenders ; ½, HomePlus Mortgage, Best Mortgage (Purchase) Lenders ; ½, LendingTree Call Center, Best Mortgage (Purchase) Lenders. LightStream is the best online lender, with rates of % - %, large loan amounts and a wide range of repayment periods. Plus, you can get funded as soon. For example, Upgrade, Upstart, and Best Egg are great options for borrowers with less-than-ideal credit. Meanwhile, First Tech offers loan amounts lower than. Reach Financial: Best for consolidating debt. Reach Financial logo · 14 · % - % · $3, - $40, ; LightStream: Best for applicants with excellent credit. Apply for an online loan, get approved in minutes, and get your deposit instantly. For lightning-fast same-day loans, apply at Minute Loan Center today. Fast & friendly cash with Lending Bear! State-licensed direct lender for online payday loans, title loans and pawn loans. Get up to $ same-day cash with. Check your personalized rates · Filter results · LightStream: Bankrate Awards Winner For Excellent Credit · Upstart: Best loan for little credit history. Wise Loan is a leading provider of the best online installment loans for all types of credit. Apply online for an installment loan of up to $ today! An online personal loan through Prosper can be an effective way to consolidate high-interest credit card debt, finance home improvements, and much more. CashNetUSA offers online loans for emergency expenses. Apply early, and if approved, you may get funded as soon as the same business day, subject to your. Direct lenders receive and process your online loan application. They also fund your loan, process your loan payments and conduct any additional service on your.

Can You Get A 20 Year Boat Loan

Find out the maximum loan term that a lender offers, which can be expressed as a number of months or years. You may find that some offer 10 year terms; others. Depending on the type of loan you're applying for and the lender, you could receive a decision within minutes. With unsecured loans, the funds are disbursed. As of September , a competitive rate for a borrower with excellent credit on a $, boat with a year term could be %. A borrower with a lower. With that said, typical boat loan terms can range from 4 to 20 years. That's much longer than the standard auto loan because boats can cost much more than a car. As of September , a competitive rate for a borrower with excellent credit on a $, boat with a year term could be %. A borrower with a lower. We offer terms up to months, or 20 bez-zatrat.ru note1. Extraordinary customer service. USAA representatives are ready to help. How to get a boat loan. Step 1. Boat loan terms can be as short as a few years, but the average boat loan term is typically 10 to 20 years. Financing can vary from one lender to the next, but. It's not hard to finance a boat, but you'll receive more favorable rates and terms if your credit score is or higher. How Old Can a Boat Be to Get Financing? Lenders typically will not finance boat loans for boats older than 20 years. If you want to purchase an older boat you. Find out the maximum loan term that a lender offers, which can be expressed as a number of months or years. You may find that some offer 10 year terms; others. Depending on the type of loan you're applying for and the lender, you could receive a decision within minutes. With unsecured loans, the funds are disbursed. As of September , a competitive rate for a borrower with excellent credit on a $, boat with a year term could be %. A borrower with a lower. With that said, typical boat loan terms can range from 4 to 20 years. That's much longer than the standard auto loan because boats can cost much more than a car. As of September , a competitive rate for a borrower with excellent credit on a $, boat with a year term could be %. A borrower with a lower. We offer terms up to months, or 20 bez-zatrat.ru note1. Extraordinary customer service. USAA representatives are ready to help. How to get a boat loan. Step 1. Boat loan terms can be as short as a few years, but the average boat loan term is typically 10 to 20 years. Financing can vary from one lender to the next, but. It's not hard to finance a boat, but you'll receive more favorable rates and terms if your credit score is or higher. How Old Can a Boat Be to Get Financing? Lenders typically will not finance boat loans for boats older than 20 years. If you want to purchase an older boat you.

Dealers and other specialized lenders typically offer to year repayment terms for a secured boat loan. If you get an unsecured loan, repayment terms may. A boat loan gives you the money to purchase a boat. You can use either a loan specific for boats or a personal loan. Bankrate reviewed and compared the best. Refinancing: If you already have a boat loan but want to search for a better interest rate or extend the term of the loan, you can refinance. Trade Allowance. Yes, you can get a year term on a used boat. However, the boat usually needs to be less than 15 years old, and most lenders will also have a minimum loan. Boat loan terms can be as long as 20 years, and some lenders allow you to pay off your loan early, without charging a prepayment penalty. If you want to buy. The loan term available will largely depend on the boat you select. We work with banks that can offer terms up to 20 years, subject to the age and type of boat. 25 to%. With a few exceptions, we do not offer loans on vessels over 20 years old,. We offer loans through several different banks, and. Most lenders will let you finance a boat for a period ranging from 5 to 20 years, with the average boat loan term being 10 to 20 years, depending on the lender. Yes, it's possible to finance a boat for 20 years. Not all investors offer extended terms on boat loans, especially for more expensive vessels or loans over. Since buying a boat is an exciting event, it can be easy to take the first loan you receive approval for and go with it. However, rushing into financing can. How different factors affect your estimated boat loan payments · Loan amount: Larger loan amounts will result in larger payments. · Loan term: Secured boat loans. Years of experience We specialize in boat financing, and have for more than 30 years. Nobody understands the market better than us. That means you can be. If you get a secured loan, which is a loan where your boat is collateral, you can usually apply for up to a year loan term. How Much to Put Down on a. We offer financing for all types of boats, including fishing boats pontoons, personal watercraft, and more! Curious if your dream boat will be covered? Get in. One of the best parts about living in Florida is being able to enjoy the water all year long. It's even better when you have your own boat or personal. Our new and used boat loans come with flexible terms and some of the lowest interest rates around. That means you can get a lower boat loan rate or monthly. If you finance a boat for over $25,, you could get a 15 loan. 20 year loans are available in amounts over $50, Arranging Your Financing Through Cope. Instead of using your savings or selling assets, financing allows you to keep your financial safety net. You can still get the boat of your dreams without. Payment example: A $76, loan for the purchase of a recreational use vessel for 20 years with a fixed rate of % would have an estimated APR of % and. In certain cases, banks may extend financing options to boats up to 20 or even 30 years old! Yes, you read that correctly – a year-old boat could still be.

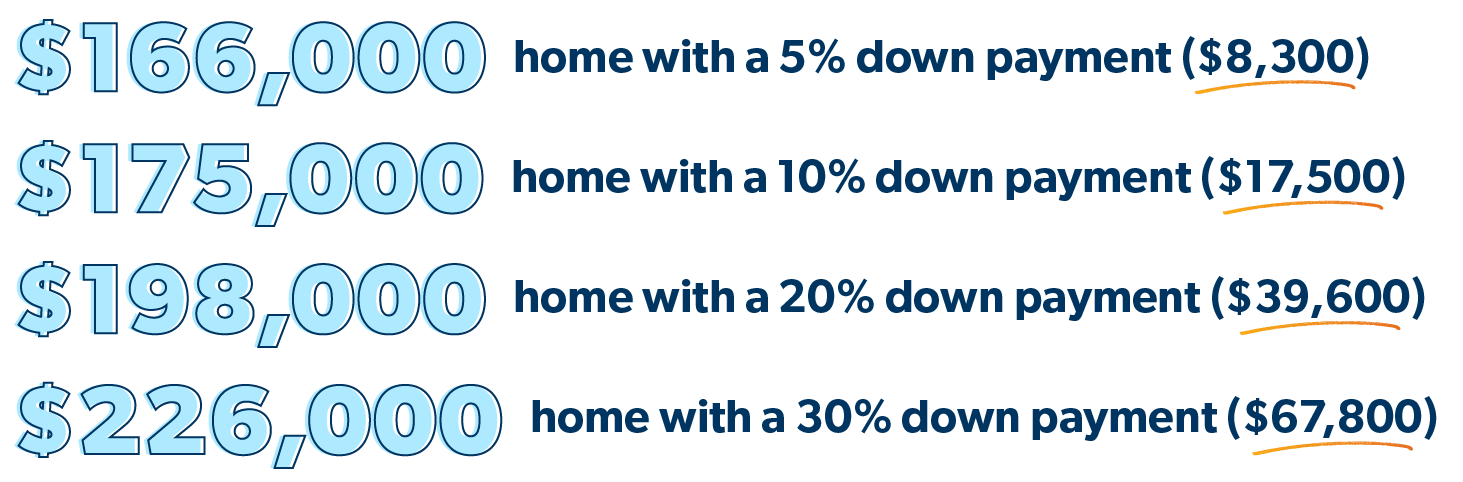

What House Can I Afford Based On Monthly Payment

Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Your mortgage payment should be 28% or less. Your debt-to-income ratio (DTI) should be 36% or less. Your housing expenses should be 29% or less. How to Calculate What You Can Afford · First, add the proposed mortgage payment to the existing debt obligations to find the total monthly debt obligation. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Your mortgage payment should be 28% or less. Your debt-to-income ratio (DTI) should be 36% or less. Your housing expenses should be 29% or less. How to Calculate What You Can Afford · First, add the proposed mortgage payment to the existing debt obligations to find the total monthly debt obligation. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources.

Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Not sure how much you can afford? Try our home affordability. If you put less than 20% down on a home, your monthly payment will also include private mortgage insurance (PMI) to help protect the lender in case you stop. Lenders use your income to calculate your debt-to-income ratio, which helps them assess your ability to make monthly mortgage payments. The higher your income. Use our home affordability tool to estimate how much house you can afford considering closing costs, mortgage, and additional fees and taxes. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Understanding the 28/36 rule for home affordability · You should spend no more than 28% of your monthly income on your housing payment · Your total debts —. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. An affordable payment is one you'll be able to make comfortably each month. This amount should follow the 28/36 rule; it should be no more than 28% of your. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. As noted in our 28/36 DTI rule section above, multiplying your gross monthly income by is a good rule of thumb for a max target mortgage payment, including. How much of a down payment do you need for a house? A 20% down payment is standard, if you can afford it. Though some mortgage loans may only require as. How much house can I afford based on my salary? Lenders will look at your salary when determining how much house you can qualify for, but you'll need to look. Deciding how much house you can afford If you're not sure how much of your income should go toward housing, start with the 28/36 rule, which dictates you. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. We ended up putting down a larger down payment, so our loan was only for k and our monthly payment is $2, If you want a k house. To find out how much house you can afford, multiply your 5% down payment by 20 to find the price of the home you'll be able to buy (5% down payment x 20 = %. Explore how much house you can afford by entering your annual income or a fixed monthly payment. To receive the most accurate affordability recommendation. How much house can I afford? · Current combined annual income · Monthly child support payments · Monthly auto payments · Monthly credit card payments · Monthly. Your total housing costs should not be more than 28% of your gross monthly income. Your total debt payments should not be more than 36%. Debt-to-income-ratio .

Best Affordable Auto Insurance

Best for discounts: Geico · Best for full coverage: Nationwide · Best for minimum coverage: Auto-Owners · Best for customer satisfaction: Amica · Best for military. GEICO is the best choice if you want the most comprehensive coverage at the best price. The provider offers full-coverage insurance for an average of $ per. GEICO offers affordable car insurance by offering competitive rates and discounts nationwide. Depending on your location, you can tap into discounts for. Geico has the cheapest car insurance for most good drivers in California. · Full coverage refers to a policy that goes beyond the minimum state requirements. Discounts & savings Allstate offers discounts on auto insurance policies, including lower premiums for safe drivers, low mileage drivers and bundled services. See which company offers the best cheap car insurance. Compare coverage options, find affordable auto insurance and save on your next policy. Compare Home. The cheapest car insurance companies by state ; Kentucky. Cheapest company. Kentucky Farm Bureau. Avg. annual premium*. $ ; Louisiana. Cheapest company. Geico. Let us save you money by helping you find the best, cheap car insurance quotes. Enter your zip code to get cheap insurance quotes. Auto Insurance Rates Are You Getting the Best Deal on Insurance? ; Geico, $ ; Liberty Mutual, $ ; Nationwide, $ ; State Farm, $ Best for discounts: Geico · Best for full coverage: Nationwide · Best for minimum coverage: Auto-Owners · Best for customer satisfaction: Amica · Best for military. GEICO is the best choice if you want the most comprehensive coverage at the best price. The provider offers full-coverage insurance for an average of $ per. GEICO offers affordable car insurance by offering competitive rates and discounts nationwide. Depending on your location, you can tap into discounts for. Geico has the cheapest car insurance for most good drivers in California. · Full coverage refers to a policy that goes beyond the minimum state requirements. Discounts & savings Allstate offers discounts on auto insurance policies, including lower premiums for safe drivers, low mileage drivers and bundled services. See which company offers the best cheap car insurance. Compare coverage options, find affordable auto insurance and save on your next policy. Compare Home. The cheapest car insurance companies by state ; Kentucky. Cheapest company. Kentucky Farm Bureau. Avg. annual premium*. $ ; Louisiana. Cheapest company. Geico. Let us save you money by helping you find the best, cheap car insurance quotes. Enter your zip code to get cheap insurance quotes. Auto Insurance Rates Are You Getting the Best Deal on Insurance? ; Geico, $ ; Liberty Mutual, $ ; Nationwide, $ ; State Farm, $

The cheapest car insurance companies for first-time drivers are Travelers, USAA, and Geico, according to WalletHub's analysis. New drivers can save as much as. Cheapest Car Insurance in North Carolina. Our research found that Erie offers the most affordable average rates in North Carolina, with a sample premium of. The cheapest car insurance in Texas is from Texas Farm Bureau, which charges an average of $70 per month for state-minimum coverage. In addition to being the. The easiest way to find the most affordable car insurance for you is by shopping around and comparing rates. SelectQuote can compare prices and coverage from. The best cheap car insurance ; Erie Insurance - $ / month ; Travelers - $ / month ; USAA - $ / month. Auto-Owners, Travelers and Geico offer some of the cheapest insurance for young adults. Young drivers may be able to save on their premiums by shopping around. Even if you have bad credit or a bad driving record, you can still find car insurance. Discounts can include a Safe Driver discount, Good Student discount, a. Get a cheap car insurance quote from Nationwide and learn how you can find affordable auto coverage you can depend on Everybody wants the best value for their. Let us walk you through everything you need to know to get reliable coverage at the best possible rate! Family out for a drive in their car in California. How. good advice and a good deal! Southern Harvest does all the hard work by putting together a custom quote with rates from Georgia's best auto insurance companies. The best overall cheap car insurance company is State Farm, with policies costing an average of $1, per year or $ per month and a MoneyGeek score of I'm paying under $90/month for max coverage on a newer sports car with a $ deductible. Includes towing and rental car as well. Their price. The cheapest car insurance company in California is Progressive, costing an average of $1, per year, or about $ per month for a good driver with a full. See which company offers the best cheap car insurance. Compare coverage options, find affordable auto insurance and save on your next policy. Compare Home. Auto-Owners, State Farm, and GEICO have the cheapest liability-only insurance rates, starting at $36, $56, and $56 monthly. Get a cheap car insurance quote in just minutes online. Freeway Insurance provides you with an affordable policy without sacrificing your coverage. USAA and Erie have the cheapest minimum liability car insurance rates, on average. This type of coverage will help you meet state liability insurance. Find cheap car insurance rates from The General®. Get a car insurance quote today and find affordable insurance coverage for your driving needs. car insurance rates from different companies to find the best price. Does the best auto insurance rate guarantee the best coverage? Not necessarily. A lower. Mercury is one of the best cheap car insurance providers in the Sooner State, offering affordable coverage without sacrificing quality. Learn more about our.

How To Get Old Student Loans Off Credit Report

If you have student loans in your name, you can find them on your credit report under installment loans. Similar to an auto loan or mortgage, student loans. Pay off other debts Your credit utilization makes up 30% of your credit score, so if you have other debts, like credit cards or a car loan, your next step. There's no legal way to remove student loans from a credit report unless the information is incorrect. If you think there's an error on your credit report, you. Listing a borrower's old servicer with a zero balance effectively closes that account on your credit report. Typically, when an account on your credit report is. Derogatory information such as delinquent accounts are not removed when an old debt is paid. Negative information remains on a consumers credit report for 7. For some borrowers, these changes mean that they will receive additional years of credit toward loan forgiveness. If you have loans that have been in repayment. You can dispute on the credit bureau website. To determine when an account will be removed by the CRAs (TransUnion, Equifax, and Experian and others), add 7 years to the date of first delinquency. The date. Loan forgiveness doesn't remove accounts from a credit report. Instead, the loans will be paid in full, and a borrower's debt-to-income (DTI) ratio will. If you have student loans in your name, you can find them on your credit report under installment loans. Similar to an auto loan or mortgage, student loans. Pay off other debts Your credit utilization makes up 30% of your credit score, so if you have other debts, like credit cards or a car loan, your next step. There's no legal way to remove student loans from a credit report unless the information is incorrect. If you think there's an error on your credit report, you. Listing a borrower's old servicer with a zero balance effectively closes that account on your credit report. Typically, when an account on your credit report is. Derogatory information such as delinquent accounts are not removed when an old debt is paid. Negative information remains on a consumers credit report for 7. For some borrowers, these changes mean that they will receive additional years of credit toward loan forgiveness. If you have loans that have been in repayment. You can dispute on the credit bureau website. To determine when an account will be removed by the CRAs (TransUnion, Equifax, and Experian and others), add 7 years to the date of first delinquency. The date. Loan forgiveness doesn't remove accounts from a credit report. Instead, the loans will be paid in full, and a borrower's debt-to-income (DTI) ratio will.

Pay off other debts Your credit utilization makes up 30% of your credit score, so if you have other debts, like credit cards or a car loan, your next step. On the Dashboard, click on “View Details” to see an overview of your loans. Scroll down to the “Loan Breakdown” section, where you'll see a list of your loans. If you're unsure who your current lender is, you can look for them on your credit report or find them by reviewing old student loan documents (such as loan. Student Loans. Learn how student loans show up on your How do I get information that was previously removed added back onto my TransUnion credit report? I'm waiting for mine to update on my credit reports. I don't necessarily want them to be removed, I just want them to show $0 balance paid in full and keep the. Talk with your credit card company, even if you've been turned down before for a lower interest rate or other help with your debt. Instead of paying a company. Defaulted Loans · reporting to a credit agency · using a private collection agency · taking legal action · recovery through the Canada Revenue Agency Refund Set-Off. A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more. During this time, it will not be possible to get credit. OPD remains on the credit report for two years after the debts are paid off, while a consumer proposal. The servicer will remove all references to the default status from your credit reports. But the previous late payments will continue to be reported. default will be removed from your credit report. Q. What if I am unable to make payments on my defaulted student loan? A. If you are unable to make payment. For example, if your loan is discharged due to borrower defense, late payments are removed from your credit report. This isn't the case if your loan is. Transunion · Ask the credit bureau to remove or correct the inaccurate or incomplete information. · Include: your complete name and address; each mistake that you. Your debt-to-income ratio will go down · You may get a refund · You could owe more in taxes · Any negative payment history may remain on your credit report. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. 1. Pull your free credit reports · 2. Find out when the debt will fall off · 3. File a dispute · 4. Get outside support · 5. Try settling the debt. When you start repaying your student loan, your monthly repayments, what to do if you have 2 jobs or are self-employed, how to get a refund if you've. Parents know a good credit score relies on paying off debt—but do your kids? Here's what teens need to know about credit reports. You may be able to ask the collection agency, the original creditor or both to request the credit bureaus delete the delinquency from your credit reports as a. While, in most cases, no credit is required to take out student loans; payments toward student debt, both on time and late, are reported to all three credit.

1 2 3 4 5