bez-zatrat.ru

Gainers & Losers

Day Trading Exit Strategies

An exit strategy in stock trading is a predetermined plan for selling a security or liquidating an investment. It dictates when and under what conditions a. An exit strategy in stock trading is a predetermined plan for selling a security or liquidating an investment. It dictates when and under what conditions a. In High Probability Trading Strategies, you will learn: A complete trade plan from entry to exit for any actively traded market and time frame including indexes. It doesn't matter if the positions are in a profit or going down in flames, as a trader you really need two exit strategies: one to handle profits and another. Discover 14 trading exit strategies professional traders use to exit their positions. Learn how to put them to work in your trading strategy. Designing an exit strategy · Look at support and resistance. · Consider setting profit and loss targets, such as a 5% profit or 5% loss. The targets should be. Learn three different order types and how certain order types, like limit orders and stop orders, can help implement your exit strategy for options trades. Designing an exit strategy · Look at support and resistance. · Consider setting profit and loss targets, such as a 5% profit or 5% loss. The targets should be. In this article, let's take a look at some tips for day trading for beginners, some intraday trading strategies and day trading strategies in order to plan a. An exit strategy in stock trading is a predetermined plan for selling a security or liquidating an investment. It dictates when and under what conditions a. An exit strategy in stock trading is a predetermined plan for selling a security or liquidating an investment. It dictates when and under what conditions a. In High Probability Trading Strategies, you will learn: A complete trade plan from entry to exit for any actively traded market and time frame including indexes. It doesn't matter if the positions are in a profit or going down in flames, as a trader you really need two exit strategies: one to handle profits and another. Discover 14 trading exit strategies professional traders use to exit their positions. Learn how to put them to work in your trading strategy. Designing an exit strategy · Look at support and resistance. · Consider setting profit and loss targets, such as a 5% profit or 5% loss. The targets should be. Learn three different order types and how certain order types, like limit orders and stop orders, can help implement your exit strategy for options trades. Designing an exit strategy · Look at support and resistance. · Consider setting profit and loss targets, such as a 5% profit or 5% loss. The targets should be. In this article, let's take a look at some tips for day trading for beginners, some intraday trading strategies and day trading strategies in order to plan a.

Since losses are inherent to the profession, developing an exit strategy involves finding, achieving, and maintaining an optimal balance where losses are offset. Exit Stage Left: Stock Exit Strategies · Setting profit targets to be hit in your time frame. · Developing trailing stop-loss points that allow for profits to be. It's recommended that day traders follow an organised trading plan that can quickly adapt to fast market movements. Just before the open of the FTSE. If you are looking for generic descriptions of exit strategies, just head to the bottom of the page. Most of the top part of the article is detailed and in-. 5 main methods of how to exit or close your trading strategies, and we provide multiple examples of how and when to exit a trading strategy. Exit strategy for daytrading · enter into a full position · lock half profits at an acceptable level (10%), keep half of your shares and raise. One key strategy many traders follow is profit taking, taking advantage of partial profit booking and using regular targets. In other words, before you start. The Twin Pillars of an Exit Strategy An all-encompassing exit strategy rests on two pillars—a stop-loss order and a profit target. Together. First up is the profit target exit strategy. It's pretty straightforward: set a specific profit target and close your position once it's reached. While a good trading strategy like a price action pattern can help you become a successful day trader, it may not be enough to keep things running. A stock exit strategy is important for both classes of investors. Short-term traders need to plan their exit points on a daily or weekly basis. But passive. The Best Intraday Entry and Exit Strategies · 1. Entering Trades Based On Market Trends · 2. Deciding the Entry Right Price · 3. Enter With A Fixed Stop Loss and. Where to exit a trade that is in profit — your profit target ; Day traders may not allow much if any retrace against the profitable trades; Swing. This way a day trader might close several minutes after opening, while a position trader will wait for at least a few days. With that said, the trading style. An exit strategy helps traders manage risk and protect capital. It provides a predefined plan for closing trades and preventing emotional reactions to market. Profitable day trading isn't easy. You need to be precise with your timing, execution, and exits, or else you'll get chopped up by paying the bid/ask spread. When discussing exit plans, we use the words such as take profit and stop loss demands to guide the types of exit strategies created. Through traders, sometimes. Time exit strategy, Defines the maximum amount of time you plan on being exposed to a particular investment. Most traders use their time exit signal as an. This blog post will provide information on effective entry and exit points when actively participating in trading activities throughout the day. What is a good risk-reward ratio? As ever on the markets, choosing your risk-reward ratio is a trade-off. · Trading exit strategies. There are several different.

Set Up Gold Ira

The first step in setting up a gold IRA is researching your options. You can choose from one of four IRA types: traditional, Roth, self-directed, and SEP. Each. This short video explains how easy it is to set up a self-directed IRA (SDIRA) to invest in precious metals. To put IRA funds into gold, you have to establish a self-directed IRA. This is a type of IRA that the investor manages directly and is permitted to own a wider. Open a New Precious Metals IRA in 3 Easy Steps! · The Self-Directed IRA. A Gold Individual Retirement Account is also called a self-directed IRA. · Moving an. Allegiance Gold offers a streamlined process that allows you to set up and fund your Precious Metals IRA in just three steps. Opening a Gold IRA involves setting up an account with a custodian, transferring funds from existing retirement accounts, and purchasing IRS-approved gold. Gold. To set up a Gold IRA, you will need to select a custodian bank or a brokerage firm that offers self-directed IRAs for holding precious metals. How Can I Setup a Gold IRA? The Gold IRA was created by the Legislative Act of Congress in and allows retirement funds to be invested in precious physical. How to Set Up a Gold IRA in 3 Steps · 1. Establish a Self-Directed IRA · 2. Deposit Funds Into Your New IRA · 3. Select Your Precious Metals for Investing. The first step in setting up a gold IRA is researching your options. You can choose from one of four IRA types: traditional, Roth, self-directed, and SEP. Each. This short video explains how easy it is to set up a self-directed IRA (SDIRA) to invest in precious metals. To put IRA funds into gold, you have to establish a self-directed IRA. This is a type of IRA that the investor manages directly and is permitted to own a wider. Open a New Precious Metals IRA in 3 Easy Steps! · The Self-Directed IRA. A Gold Individual Retirement Account is also called a self-directed IRA. · Moving an. Allegiance Gold offers a streamlined process that allows you to set up and fund your Precious Metals IRA in just three steps. Opening a Gold IRA involves setting up an account with a custodian, transferring funds from existing retirement accounts, and purchasing IRS-approved gold. Gold. To set up a Gold IRA, you will need to select a custodian bank or a brokerage firm that offers self-directed IRAs for holding precious metals. How Can I Setup a Gold IRA? The Gold IRA was created by the Legislative Act of Congress in and allows retirement funds to be invested in precious physical. How to Set Up a Gold IRA in 3 Steps · 1. Establish a Self-Directed IRA · 2. Deposit Funds Into Your New IRA · 3. Select Your Precious Metals for Investing.

Bishop Gold Group is here to help you set up and manage your gold IRA. With the following four steps, we assist you in opening your retirement account. Account Setup Fees: You may have to pay a fee to begin processing a new gold IRA account. · Custodian Annual Maintenance Fee: These fees cover bookkeeping and. Thanks to the ingenuity of the Taxpayer Relief Act of , American investors can invest in physical gold within a self-directed IRA. Since its passage, SIMPLE. Why should I consider adding gold & precious metals to a Self-Directed IRA? · A Self-Directed IRA provides: · Product qualifications for Self-Directed Precious. We'll walk you through the steps of setting up a Gold IRA, including selecting a custodian, funding your account, choosing metals, and arranging for secure. There is a simple way to buy physical bullion and avoid the taxes and penalties associated with liquidating an IRA prior to age ½. You can set up a Self-. You can set up a Self-Directed IRA for gold and silver investments with Madison Trust, one of the best Gold IRA companies, in six simple and secure steps. Best financial advisor for physical gold IRAs: American Bullion emphasizes investor education on precious metals investing and recommends a $10, minimum. Setting up a gold IRA need not be difficult, expensive, or time-consuming. We are happy to assist you in filling out your account set-up forms. A gold IRA works like a traditional IRA or Roth IRA. But, it lets you invest in physical precious metals. You can put money into a gold IRA with. To set up a self-directed gold and precious metals IRA, you must work with a custodian specializing in alternative assets. The custodian will help you. Setting up a gold IRA · Choose a dealer: To put physical precious metals in an IRA, you need to work in conjunction with a metals dealer, a custodian (usually a. And if you don't have an IRA, we'll walk you through the simple set-up process and your many exciting options for IRA-eligible precious metals. Call 1. Choose the Type of Gold IRA. The type of self-directed gold IRA you set up will be dependent on how you want to fund your IRA. · 2. Decide on a Funding Source. Then, you can use the money to buy your precious metals. This cash transfer option is the easiest way for you to fund your IRA account. Note that the IRA sets. A Platinum IRA is an IRA with some of all of its assets invested in IRA approved forms of Platinum bullion. A Platinum IRA is generally set up through a self-. The IRS has particular policies about what kind of gold can be included in an IRA. It needs to be % pure, and only specific coins and bars are qualified. Gold IRAs can be set up as pretax IRAs, Roth IRAs, and SEP-IRAs. · They're subject to the same annual contribution limits. · Investors who are under age 59 1/2. In this article we'll help you navigate the process by clearly outlining each step you have to take to set up your own gold IRA. You can't set up a gold IRA account at just any financial institution; you need to find a self-directed IRA custodian. The term “self-directed” means you can.

Dave And Busters Vs Main Event Prices

Whatever the event, Dave & Buster's is the perfect place for all ages to have a party. Book your party or contact one of our Planners to do the work for you. Main Event's Logo. Main Event. See how Punch Bowl Social compares Dave & Buster's rates % higher than Punch Bowl Social on Leadership Culture Ratings vs. They seem to grossly inflate their pricing, and they don't typically have sufficient staff to keep the customer experience running smoothly and consistently. Beat the midweek blues with 1/2 Price Games all day long, every Wednesday at Dave & Buster's! Get ready for UFC tonight with the main event: Du Plessis. Whatever the event, Dave & Buster's is the perfect place for all ages to have a party. Book your party or contact one of our Planners to do the work for you. This included bowling, laser tag, billiards and shuffleboard. It did not include bowling shoes, food or the arcade but that was fine with us. We played multiple. Arcade, tabletop, air hockey or traditional gaming, Dave & Buster's has it all. Prices may vary by location. Valid at participating locations only. Not. Dave & Buster's ; David O. Corriveau James W. "Buster" Corley · Dallas, Texas, U.S. · · Chris Morris (CEO) · Main Event Entertainment. Dave & Buster's rates % lower than Main Event on Sentiment Culture Ratings vs Main Event Ratings based on looking at ratings from employees of the two. Whatever the event, Dave & Buster's is the perfect place for all ages to have a party. Book your party or contact one of our Planners to do the work for you. Main Event's Logo. Main Event. See how Punch Bowl Social compares Dave & Buster's rates % higher than Punch Bowl Social on Leadership Culture Ratings vs. They seem to grossly inflate their pricing, and they don't typically have sufficient staff to keep the customer experience running smoothly and consistently. Beat the midweek blues with 1/2 Price Games all day long, every Wednesday at Dave & Buster's! Get ready for UFC tonight with the main event: Du Plessis. Whatever the event, Dave & Buster's is the perfect place for all ages to have a party. Book your party or contact one of our Planners to do the work for you. This included bowling, laser tag, billiards and shuffleboard. It did not include bowling shoes, food or the arcade but that was fine with us. We played multiple. Arcade, tabletop, air hockey or traditional gaming, Dave & Buster's has it all. Prices may vary by location. Valid at participating locations only. Not. Dave & Buster's ; David O. Corriveau James W. "Buster" Corley · Dallas, Texas, U.S. · · Chris Morris (CEO) · Main Event Entertainment. Dave & Buster's rates % lower than Main Event on Sentiment Culture Ratings vs Main Event Ratings based on looking at ratings from employees of the two.

or bez-zatrat.ru more · See all reviews. Main Event Entertainment. 6. Main Event Dave and Busters. More catered to the grown folk. Your small children are. " Monday Night Madness is a great deal of $ for all-you-can-play activities or arcade games. Consent is not a condition of purchase. Msg & data rates. By. My personal experience with Main Event/Dave & Busters is that they have a good work environment, considerate management, work drama is kept to a minimum. Bowling 22 lanes of bowling! Bowling is transformed with leading edge scoring systems, swanky lounge seating, a variety of the latest music videos or sporting. All you can play activities or games are just $ per person after 4pm on Mondays! Just because the week has started doesn't mean the party has to stop! Host your event at Dave & Buster's in San Antonio, Texas with Parties from $ to $ for 50 Guests. Eventective has Party, Meeting, and Wedding Halls. Dave & Buster's and Main Event brands on a permanent or temporary basis. The components of the purchase price and net assets acquired in the Main Event. INSTANT DELIVERY. Purchase today and receive your unique Arcade Credit barcode! After you checkout, you'll receive a link to redeem your purchase. We will send. " Monday Night Madness is a great deal of $ for all-you-can-play activities or arcade games. Consent is not a condition of purchase. Msg & data rates. By. Here is a detailed look at the top 21 alternatives to Dave & Buster's, including what makes each one unique: Main Event Entertainment; Round1. While not identical, these two tins are incredibly similar in taste and texture despite a big difference in price. Fishwife's marketing is a plus for bringing. Apparently it was a special day price per activity. Bowled for 2 1/4 hours and had a few drinks, couldn't fault the bowling or the bar service and didn't have. at Dallas Dave & Buster's located at North Central Expressway, Dallas TX. Call us today at () - to reserve a table for your next event! Select one of our breakfast, lunch, or dinner packages and host a meeting or conference unlike any other. With private rooms and AV equipment, Dave & Buster's. Dave & Buster's is the ONLY place with a restaurant serving everything from wings to New York Strips, a bar (or two) with the best happy hour, and a Million. Main Event. Dave and Busters has gotten a little run down. Specifically the one in the Marque. I was hesitant to try Dave and Busters Because it's a chain and I have 5 children. Main Event Entertainment. Entertainment. Kids Bowl Free. Not valid with any other offers, including Half Price Games Wednesdays or any Half Price Game promotion. Not valid with Special Events Packages or Virtual. Whatever the event, Dave & Buster's is the perfect place for all ages to have a party. Book your party or contact one of our Planners to do the work for you. or bez-zatrat.ru more · See all reviews. Main Event Entertainment. 6. Main Event Dave and Busters. More catered to the grown folk. Your small children are.

Did The Stock Market Crash Today

The table below highlights 25 international crises that have occurred since During these events, the Dow Jones Industrial Average (DJIA) dropped by an. However, when the depression hit, these investors worsened their overall financial situations because not only did they lose everything they owned, they also. Stocks fell Thursday as traders processed comments from Federal Reserve Chairman Jerome Powell and awaited key employment data. However, as a singular event, the stock market crash itself did not cause the Great Depression that followed. A strong stock market relies on today's. Sensex crashes over points. Early signs of a U-turn on one-way Street? Sensex Crash Today: In percentage terms, today's decline in Nifty was the. The Dutch Tulip Bulb Market Bubble, also known as Tulipmania took place in The Financial Crisis of to was the first U.S. stock market crash. There were five S&P stocks making new lows not seen in more than a year on Monday as the index struggled. These include Dow component Boeing, which has. The Dow Jones Industrial Average (DJIA) dropped by slightly more than 22%. The S&P Index suffered a similar decline of %. To give you some perspective. This is a list of stock market crashes and bear markets. The difference between the two relies on speed (how fast declines occur) and length (how long they. The table below highlights 25 international crises that have occurred since During these events, the Dow Jones Industrial Average (DJIA) dropped by an. However, when the depression hit, these investors worsened their overall financial situations because not only did they lose everything they owned, they also. Stocks fell Thursday as traders processed comments from Federal Reserve Chairman Jerome Powell and awaited key employment data. However, as a singular event, the stock market crash itself did not cause the Great Depression that followed. A strong stock market relies on today's. Sensex crashes over points. Early signs of a U-turn on one-way Street? Sensex Crash Today: In percentage terms, today's decline in Nifty was the. The Dutch Tulip Bulb Market Bubble, also known as Tulipmania took place in The Financial Crisis of to was the first U.S. stock market crash. There were five S&P stocks making new lows not seen in more than a year on Monday as the index struggled. These include Dow component Boeing, which has. The Dow Jones Industrial Average (DJIA) dropped by slightly more than 22%. The S&P Index suffered a similar decline of %. To give you some perspective. This is a list of stock market crashes and bear markets. The difference between the two relies on speed (how fast declines occur) and length (how long they.

did not return to its pre-Crash levels until November 23, Explain why small-time investors in the stock market crash of lost their savings. Key Takeaways · Black Monday refers to the stock market crash that occurred on October 19, , when the DJIA lost % in a single day, triggering a global. Committed to the preservation of the gold standard and balanced budgets, policymakers did not use monetary or fiscal policies to stabilize the economy, greatly. Global stock markets have tumbled in recent days, as economic warning signs shook the US and the rest of the world felt the reverberations. Stock market today: Indexes close lower as comeback rally loses momentum. Stocks were dragged lower as investors continued to fret over recession risks and took. Stocks fell Thursday as traders processed comments from Federal Reserve Chairman Jerome Powell and awaited key employment data. The average stock market price decline is % and the average length of a market crash is days. Stock market crashes since Source. On this day the market fell 33 points — a drop of 9 percent — on trading that was approximately three times the normal daily volume for the first nine months of. Across two days of chaos, the Dow Jones fell by 23%, and the market lost approximately 85% of its original value. The years that followed the stock market crash. Stock market today Sensex Nifty: The high froth in the midcap and smallcap indices is now settling as the gauges see a heavy correction, and this correction is. Asia's richest man lost $13 billion in China crash · China has spent $ billion on its market bailout. Why did China crash the yuan? China has spent $ What bankers say you should (and shouldn't) do when markets crash. In recent days, financial markets have shifted from confident to fearful as grim. Markets ; Dow Jones Global. Dow Jones Industrial Average. 41, % ; S&P US. S&P Index. 5, % ; Nasdaq. NASDAQ Composite Index. What did we learn from this month's stock market crash? Nothing. Two weeks ago, fear that global finance was on the eve of destruction caused a wave of panic. Global stock markets have tumbled in recent days, as economic warning signs shook the US and the rest of the world felt the reverberations. Throughout the s a long boom took stock prices to peaks never before seen. From to stocks more than quadrupled in value. Many investors became. Historical stock market crashes in the U.S. occurred in , , , , and Following a stock market crash, panic trading can be prevented by. Silver price today · Gold · Gold That was the dynamic of markets in , and it created deep fear, expecting a market crash in which did not occur. View the full Dow Jones Industrial Average (bez-zatrat.ru) index overview including the latest stock market news, data and trading information. The Wall Street Crash of , also known as the Great Crash, Crash of '29, or Black Tuesday, was a major American stock market crash that occurred in the.

How Do You Get The Equity Out Of Your Home

A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. Subtract from that the amount you owe on your home loan and the remainder is your useable equity. Once you have a reasonable idea of your home's potential. A home equity loan allows you to cash out up to 80% of the value of the home (minus mortgage balance). While it is possible to use that money to fund the. If you pay more than your scheduled mortgage payment every month, you're putting extra money toward your principal amount rather than interest, which increases. When homeowners need extra cash, they often borrow against the equity in their home, known as home equity loans or lines of credit (HELOC). Refinancing is often a tactic used to free up the equity you have in your current home in order to fund purchases or lifestyle goals. Our home loan expert. The most common options for tapping the equity in your home are a HELOC, home equity loan or cash-out refinance. Home equity loans and HELOCs have roughly. Consider contacting your current lender to see what they offer you as a home equity loan. They may be willing to give you a deal on the interest rate or fees. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. Subtract from that the amount you owe on your home loan and the remainder is your useable equity. Once you have a reasonable idea of your home's potential. A home equity loan allows you to cash out up to 80% of the value of the home (minus mortgage balance). While it is possible to use that money to fund the. If you pay more than your scheduled mortgage payment every month, you're putting extra money toward your principal amount rather than interest, which increases. When homeowners need extra cash, they often borrow against the equity in their home, known as home equity loans or lines of credit (HELOC). Refinancing is often a tactic used to free up the equity you have in your current home in order to fund purchases or lifestyle goals. Our home loan expert. The most common options for tapping the equity in your home are a HELOC, home equity loan or cash-out refinance. Home equity loans and HELOCs have roughly. Consider contacting your current lender to see what they offer you as a home equity loan. They may be willing to give you a deal on the interest rate or fees. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value.

With a cash-out refinance, you pay off your current mortgage and create a new one, allowing you to keep part of your home's equity as cash to pay for the things. Home equity is the value of your house minus the amount you owe on your mortgage or home loan. When you first buy a house, your home equity is the same as your. With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your. 1. Draft a rent-back agreement · 2. Write a contingency into your contract · 3. Take out a Home Equity Line of Credit (HELOC) · 4. Get a bridge loan. Retired homeowners who have paid off their mortgage can sell their home and cash out the equity by downsizing. Further, homeowners 62 and older have the option. Selling with equity can pay off your mortgage debt, provide flexibility, and avoid the credit damage caused by foreclosure. Depending on the amount of equity. To calculate your home equity, subtract the amount of the outstanding mortgage loan from the price paid for the property. At the time you buy, your home equity. Take a look at these five alternatives to a cash-out refinance to see how they compare and find the solution that best suits your financial needs. With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your. 1. Draft a rent-back agreement · 2. Write a contingency into your contract · 3. Take out a Home Equity Line of Credit (HELOC) · 4. Get a bridge loan. Cash-out refinancing, which replaces your current mortgage loan with a larger one and gives you the difference in cash. The more equity you have, the more cash. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. You could take out a home equity loan or line of credit, or you could refinance your mortgage and take out some extra money. However, be aware. If you pay more than your scheduled mortgage payment every month, you're putting extra money toward your principal amount rather than interest, which increases. A cash-out refinance allows you to replace your existing mortgage with a home loan for more than what you owe. You pocket the cash difference between the two. Whatever amount you borrow, you can use the loan to fund your projects: roof upgrade, new patio deck, interior renovations, etc. Whenever you take out a loan. Home equity is the difference between what you owe on your mortgage and what your home is currently worth. You build equity in your home each time you make a. A cash-out refinance allows you to replace your existing mortgage with a home loan for more than what you owe. You pocket the cash difference between the two. It's known as a Home Equity Line of Credit (HELOC). With a HELOC you borrow funds against the equity in your home on a need basis. Instead of taking out a full. Mortgage equity is essentially the difference between what you owe on your mortgage and the current value of the property. For example, if your home is worth £.

Stock Buying Algorithm

Short selling. Trade without directional bias. Alpaca's trading API allows you to run long/short or market neutral strategies. Trade Execution Algorithms: They split the trades into smaller orders so that the impact on the stock price can be lessened. Commonly used trade execution. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. The Markowitz optimization is an interesting algorithm because it is predicated on normally distributed returns, however stock market returns are subject to the. PDF | Algorithm trading relies on the automatic identification of buying and selling points of a given asset to maximize profit. In this paper, we. The global algorithmic trading market size was valued at $ billion in & is projected to grow from $ billion in to $ billion by In today's article, we will talk about Algorithm Trading and its top seven strategies you should practice to get the best return on investments. Algorithmic trading works by using computer programs to execute trades automatically based on pre-defined criteria, such as price, volume, or. What is Algorithmic Trading? Algorithmic trading strategies involve making trading decisions based on pre-set rules that are programmed into a computer. Short selling. Trade without directional bias. Alpaca's trading API allows you to run long/short or market neutral strategies. Trade Execution Algorithms: They split the trades into smaller orders so that the impact on the stock price can be lessened. Commonly used trade execution. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. The Markowitz optimization is an interesting algorithm because it is predicated on normally distributed returns, however stock market returns are subject to the. PDF | Algorithm trading relies on the automatic identification of buying and selling points of a given asset to maximize profit. In this paper, we. The global algorithmic trading market size was valued at $ billion in & is projected to grow from $ billion in to $ billion by In today's article, we will talk about Algorithm Trading and its top seven strategies you should practice to get the best return on investments. Algorithmic trading works by using computer programs to execute trades automatically based on pre-defined criteria, such as price, volume, or. What is Algorithmic Trading? Algorithmic trading strategies involve making trading decisions based on pre-set rules that are programmed into a computer.

Algorithms trade stocks, bonds, currencies, and a plethora of financial derivatives. Algorithms are also fundamental to investment strategies and trading goals. The Oracle Algorithm sifts through 15, stocks every second, searching for 5-to-1 risk ratios, generating 15 trading opportunities a day. Get Daily Alerts. As the large institutional investors deal in a large amount of shares, they are the ones who make a large use of algorithmic trading. It is also popular by the. The Oracle Algorithm sifts through 15, stocks every second, searching for 5-to-1 risk ratios, generating 15 trading opportunities a day. Get Daily Alerts. Simply creating an algorithm — a set of rules to automate stock buys and sells — can be done for little to no expense. Trading execution algorithms are one of many ways advisors can leverage trading technology for their clients. · Advisors trading large blocks of ETFs or stocks. Algorithmic trading aims to carry out transactions by employing automated, predetermined directives that surpass the efficiency of human traders. Machine learning algorithms can process social media content such as tweets, posts, and comments of people who generally have stakes in the stock market. This. In this case, one can write and design an algorithm in such a way that the buy order for the particular stock is met when price is at a prespecified low and. The algorithmic trading process typically begins with the development of a trading strategy. This strategy can be based on a variety of factors, including. Algo-trading executes trades by using pre-defined programmings. Learn the basic concept of algorithmic trading with examples at Angel One website. Start commission-free algorithmic trading with Alpaca's Trading API for stock, options and crypto There are risks unique to automated trading algorithms that. Given an array prices[] of size N denoting the cost of stock on each day, the task is to find the maximum total profit if we can buy and sell the stocks any. The algorithmic trading strategies follow defined sets of rules, and are based on timing, price, quantity or any mathematical model. Apart from profit. Build Alpha is widely considered the best algorithmic trading software due to its large suite of professional stress tests and robustness tests. These. A trading algorithm is a series of steps to make a buy or sell order in the stock market. According to current market conditions, your order can be executed or. Available Execution Strategies · VWAP (Volume Weighted Average Price) Pre-trade schedule based on historical volumes. · TWAP (Time Weighted Average Price). “Algo-trading is the use of predefined programs to execute trades. A set of instructions or an algorithm is fed into a computer program and it automatically. Algorithmic trading refers to automated trading with the use of live market data and rule-driven computer programs for automatically submitting and allocating.

Scalp Trading Bot

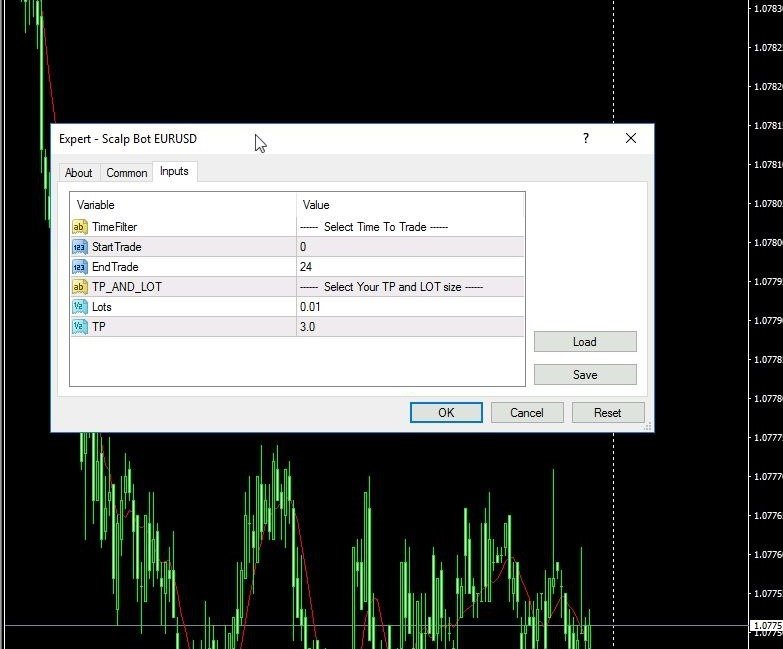

Scalping bots automate the scalping process by identifying and executing trades based on particular conditions and rules. Creating a Scalping Bot. The first thing is to create our rule with an opening order. We use the simple rule from earlier as our building block. Scalping bots are automated trading programs designed to execute a high-frequency trading strategy known as scalping. Scalp bot uses short-range AI scores, Swing bot uses a combination of short & long range AI scores, as an average to find best places to increase/decrease. Scalp Bot EURUSD: 15% Discount Going on Previous Price $ Current Price $ Contact @mahicmc21 telegram EA Strategy Take scalp Positions in Higher Time. NinjaTrader algorithmic trading courses, automated trade systems, high frequency trading. Scalping Bot for NinjaTrader 8 NinzaRenko Bars. Scalp the Trend. Scalping Bot. The purpose of this strategy is to spot when it's the most suitable time to buy an asset profiting from a potential short-term price increase. The Scalprobot trading bot has outperformed most investment professionals, benchmark indices or crypto. Maximize your returns with this amazing trading. I am working on a scalping bot that aims to make anywhere from $5 to $50 in one trade (buy shares and sell them is one trade). Scalping bots automate the scalping process by identifying and executing trades based on particular conditions and rules. Creating a Scalping Bot. The first thing is to create our rule with an opening order. We use the simple rule from earlier as our building block. Scalping bots are automated trading programs designed to execute a high-frequency trading strategy known as scalping. Scalp bot uses short-range AI scores, Swing bot uses a combination of short & long range AI scores, as an average to find best places to increase/decrease. Scalp Bot EURUSD: 15% Discount Going on Previous Price $ Current Price $ Contact @mahicmc21 telegram EA Strategy Take scalp Positions in Higher Time. NinjaTrader algorithmic trading courses, automated trade systems, high frequency trading. Scalping Bot for NinjaTrader 8 NinzaRenko Bars. Scalp the Trend. Scalping Bot. The purpose of this strategy is to spot when it's the most suitable time to buy an asset profiting from a potential short-term price increase. The Scalprobot trading bot has outperformed most investment professionals, benchmark indices or crypto. Maximize your returns with this amazing trading. I am working on a scalping bot that aims to make anywhere from $5 to $50 in one trade (buy shares and sell them is one trade).

Scalping crypto is a short-term trading strategy that capitalizes on minor price fluctuations in price movements to reap small, frequent profits. Get Auto Trading Scalping Robot With Recovery System from Top rated Upwork Freelancer Abdelmaseh A with % job success rate. Learn more about the BTC Super Scalper v2 automated cryptocurrency trading strategy on Compendium! Create an account, subscribe to this bot. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the. Crypto scalping is an intraday trading strategy that involves executing numerous short-term trades to capitalize on small price movements. Ways to trade with Gunbot When enabled, the strategy leverages short, medium, and long-term trend data to manage trades specifically during micro scalping. So you want to trade high volume hours in the market as a scalper. The best time of day to trade that usually has the highest volume throughout the day would. Scalping Trading Bot X Scalping Project: This scalping trading bot, developed by New Capital B.V., is a cutting-edge trading bot harnessing the power of. OctoBot is not responsible for any potential losses incurred using these opportunities if you choose to trade with them. trading bot is a good idea to automate your trading. Go to our website for Best Scalping Robot in - Test this MT4 Scalp Bot in a Demo. Best. Find the best scalping bot services you need to help you successfully meet your project planning goals and deadline. Coinrule™ Solana Trading Bot 【 SOL Robot 】 If you have confidence with the price moves of Solana, this rule tries to scalp price rebounds from oversold. As a trader, I'm always on the lookout for ways to improve my trading performance and maximize profits. That's why I decided to create my. scalp trading strategies and avoiding trading with emotions. You can use various indicators or a Bitcoin scalper bot or EA to automate your trades. Learn more about the Elastic Scalp BTC automated cryptocurrency trading strategy on Compendium! Create an account, subscribe to this bot. In both manual and automated trading, scalping requires precision, intuitive knowledge, and a clear understanding of how the crypto market works. Automated bot. Get crypto scalping bot, crypto trading bot, bot development, scalp trading bot from Upwork Freelancer Ademola A. 3Commas Crypto Trading Platform - Smart tools for cryptocurrency investors ✓ Useful information about smart trading and crypto trading bots. A python bot that lets you trade in most crypto exchanges and allows you to optimize your strategies with machine learning. EA Trading Academy does not hold registration as an investment advisor, broker, or dealer. The provided educational materials do not constitute professional.

Dating Services For Over 60

Ready To Start Your Over 60s Dating Journey? If you're ready and raring to go to begin your search for someone fun, register for Ourtime today! It's free to. You can find senior singles over sixty on the internet. There are many top-tier dating websites available all around the web, and there are even some. Welcome To Singles Over 60 Dating New York Probably New York's favourite over 60 dating website. Join for free today to meet local singles over 60 in the. Dating for older singles of all ages · Dating for over 40s: EliteSingles · Dating for over 50s: eHarmony · Dating for over 60s & 70s: Senior FriendFinder. Join one of USA's best over 60 dating websites today and view your senior matches for free. Our service is confidential, secure, and easy to use. Download the Dating for Seniors app to chat and meet with single seniors. Looking for a single seniors community? Still trying to find a silver senior soulmate? As a mature dating expert, SilverSingles is one of the top sites for over 60 dating. Our accessible and straightforward service is easy-to-use and gets. Dating Over What do Single Men Over 60 Really Want? Lisa Copeland's Interview. Sixty and Me · You May Hate This Senior Dating Advice. bez-zatrat.ru has inspired twice as many marriages as any other site, with hundreds of thousands of singles finding love through our online dating personals. Start. Ready To Start Your Over 60s Dating Journey? If you're ready and raring to go to begin your search for someone fun, register for Ourtime today! It's free to. You can find senior singles over sixty on the internet. There are many top-tier dating websites available all around the web, and there are even some. Welcome To Singles Over 60 Dating New York Probably New York's favourite over 60 dating website. Join for free today to meet local singles over 60 in the. Dating for older singles of all ages · Dating for over 40s: EliteSingles · Dating for over 50s: eHarmony · Dating for over 60s & 70s: Senior FriendFinder. Join one of USA's best over 60 dating websites today and view your senior matches for free. Our service is confidential, secure, and easy to use. Download the Dating for Seniors app to chat and meet with single seniors. Looking for a single seniors community? Still trying to find a silver senior soulmate? As a mature dating expert, SilverSingles is one of the top sites for over 60 dating. Our accessible and straightforward service is easy-to-use and gets. Dating Over What do Single Men Over 60 Really Want? Lisa Copeland's Interview. Sixty and Me · You May Hate This Senior Dating Advice. bez-zatrat.ru has inspired twice as many marriages as any other site, with hundreds of thousands of singles finding love through our online dating personals. Start.

Welcome To Singles Over 70 Dating Singles Over 70 is probably Canada's favorite over 70 dating website. Join today and find local senior singles you would. Via the various apps and websites, such as bez-zatrat.ru, singles can talk with and get to know others before ever meeting in person. This can help jump-start, and. Best Senior Dating Sites in New Zealand · Singles50 · 60sDating · 50slove. Popular dating services for the elderly range from the mainstream, such as Match and eHarmony, to niche sites such as Silver Singles, which. Looking for a single seniors community? Still trying to find a silver senior soulmate? Join our community at Dating for Seniors! Download the Dating for. Looking for a single seniors community? Still trying to find a silver senior soulmate? Join our community at Dating for Seniors! Download the Dating for. Explore the world of senior dating with our guide on navigating love and relationships over Find insights on building lasting connections. Mature singles trust bez-zatrat.ru for the best in 50 plus dating. Here, older singles connect for love and companionship. Looking For dating sites for over 60 Dating Sites? Here Are Top Sites for You Bookofmatches is an online meeting place for singles looking to find. Singles Over 60 is a safe online community with a vast and ever-growing database of fun-loving singles and like-minded people who want the same thing in life as. Download the Dating for Seniors app to chat and meet with single seniors. Looking for a single seniors community? Still trying to find a silver senior soulmate? Plenty of Fish has one of the largest dating apps and websites with thousands of active singles at every age! We've got singles in every age bracket, yes even. bez-zatrat.ru is an excellent and exciting authentic site for seniors, who are looking for Christian dating sites for over 60 and haven't had much (or no). Online dating with senior women 60 plus allows you to tap into an online community of open-minded people looking for relationship-minded individuals like. ❤Google Play Editor's Choice❤ - Trusted Mature Dating App for 50+ Silver Singles SeniorMatch is the #1 senior dating app for older women and mature men. Senior Dating at bez-zatrat.ru One of the largest and most successful senior dating sites for baby boomers and mature singles! SeniorMatch focuses on users. You can find senior singles over sixty on the internet. There are many top-tier dating websites available all around the web, and there are even some. Looking For dating sites for over 60 Dating Sites? Here Are Top Sites for You Bookofmatches is an online meeting place for singles looking to find. SeniorMatch - top senior dating site for singles over Meet senior people and start mature dating with the best 50 plus dating website and apps now! some of the most popular dating websites for over 60s consist of bez-zatrat.ru, eharmony, and okcupid. once you've found a dating website, you'll want to produce a.

Average Florida Home Insurance Cost

The average cost of homeowners insurance in Florida is $2, a year for $K in dwelling coverage, 18% less than the national average. Average cost of homeowners insurance by state ; Florida, $1, ; Georgia, $1, ; Hawaii, $ ; Idaho, $ Homeowners insurance in Florida typically costs between $1, and $2, per year, based on our study. The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). $ – Florida; $ – Louisiana; $ – Oklahoma; $ – Texas; $ – Rhode Island; $ – Colorado. Over a year period. The most recent data published by the Insurance Information Institute puts the average cost of homeowners insurance in Florida at $2, per year. That makes. Florida ; Hollywood. Average annual premium for $K dwelling coverage. $8, ; Pompano Beach. Average annual premium for $K dwelling coverage. $7, Through an agent · Get a quote · Or, call Our analysis of rates determined that the cost of home insurance in Florida is $3, per year, based on the average of dwelling coverage limits from $, The average cost of homeowners insurance in Florida is $2, a year for $K in dwelling coverage, 18% less than the national average. Average cost of homeowners insurance by state ; Florida, $1, ; Georgia, $1, ; Hawaii, $ ; Idaho, $ Homeowners insurance in Florida typically costs between $1, and $2, per year, based on our study. The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). $ – Florida; $ – Louisiana; $ – Oklahoma; $ – Texas; $ – Rhode Island; $ – Colorado. Over a year period. The most recent data published by the Insurance Information Institute puts the average cost of homeowners insurance in Florida at $2, per year. That makes. Florida ; Hollywood. Average annual premium for $K dwelling coverage. $8, ; Pompano Beach. Average annual premium for $K dwelling coverage. $7, Through an agent · Get a quote · Or, call Our analysis of rates determined that the cost of home insurance in Florida is $3, per year, based on the average of dwelling coverage limits from $,

The average cost of home insurance in Florida is $1, per year, according to the National Association of Insurance Commissioners. However, this number can. Florida county or company to view the associated sample average homeowners insurance rates. Introduction. The cost of homeowners insurance in Florida can. Florida homeowners pay the most for home insurance, with an average annual rate of $10, in · Louisiana pays the second-highest home insurance rate, at. MoneyGeek reports that the average cost of homeowners insurance in Florida is $2, a year for $K in dwelling coverage, which is 18% less than the national. Average premium is a year, but down here with the cost of insurance and the high deductibles, it almost makes sense just to self insure if able. The average cost of homeowners insurance is $ per year, but rates vary greatly depending on the company, your coverage needs and your house's rebuild. The average home insurance cost for Florida homeowners in was $10,, but Insurify predicts a 7% increase in , to $11, The cheapest homeowners. The average cost of homeowners insurance in Tampa is $5, per year (for the coverage level of $, for dwelling, $, for liability protection and. Average cost of homeowners insurance by state ; Florida, $1, ; Georgia, $1, ; Hawaii, $ ; Idaho, $ The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). The average cost for homeowners insurance in Florida is per year or $ per month. Relative to the rest of the US at $, Floridians' home insurance rates. On a county-by-county basis, it found that Sumter County has the lowest average cost for single-family home property insurance at $1,, while Monroe County. (5) Florida data exclude policies written by Citizens Property Insurance average premium for homeowners insurance is artificially high. Note: Average. Of the five Florida companies analyzed, Security First offers cheapest home insurance rates on average for a $K home, followed by State Farm. Compare the. On average, Florida homeowners paid about $6, in , making it the state with the highest premiums in the U.S.. Florida is facing a real insurance crisis. However, the average homeowners insurance in Naples is comparable to the entire state of Florida. Your home insurance cost will range from $1, to $4, a. Nationally, homeowners pay an average premium of $ per year. The average cost of homeowners insurance in Florida is about $5, annually, with rates ranging from $3, to $8, for most people. However, you may. The average cost of homeowners insurance in South Florida — which only includes the Tri-County area of Broward, Miami-Dade and Palm Beach counties — is annually.

Rich Borrow Against Stock

The idea is to purchase investments that appreciate in value, borrow against those assets, and use them as collateral for loans, then pass on. While ordinary workers are taxed on their wages as they earn them, billionaires can borrow against their growing investments year after year without owing a. What it is: Just as a bank can allow you to borrow against the equity in your home, your brokerage firm can lend you money against the value of eligible stocks. The interest, for those investing in publicly-traded securities, may also be tax deductible. One risk is an investment made from borrowed money may drop in. Read about three asset-backed lending solutions—HELOC, margin, and securities-based lines of credit—and under what circumstances you might consider using. Securities-based lending is the process of pledging a portfolio of, say, blue chip equities or municipal bonds, as collateral to back up a loan of around 50 to. They do this because selling stock is taxed, but loans aren't. And the interest payments on loans is far lower than the taxes due from a stock. It's not just the rich, anyone can use assets for collateral. Borrowing against assets allows you to keep those assets, assuming you can service. A securities-based line of credit helps you to meet your liquidity needs by unlocking the value of your investments without selling them. This type of borrowing. The idea is to purchase investments that appreciate in value, borrow against those assets, and use them as collateral for loans, then pass on. While ordinary workers are taxed on their wages as they earn them, billionaires can borrow against their growing investments year after year without owing a. What it is: Just as a bank can allow you to borrow against the equity in your home, your brokerage firm can lend you money against the value of eligible stocks. The interest, for those investing in publicly-traded securities, may also be tax deductible. One risk is an investment made from borrowed money may drop in. Read about three asset-backed lending solutions—HELOC, margin, and securities-based lines of credit—and under what circumstances you might consider using. Securities-based lending is the process of pledging a portfolio of, say, blue chip equities or municipal bonds, as collateral to back up a loan of around 50 to. They do this because selling stock is taxed, but loans aren't. And the interest payments on loans is far lower than the taxes due from a stock. It's not just the rich, anyone can use assets for collateral. Borrowing against assets allows you to keep those assets, assuming you can service. A securities-based line of credit helps you to meet your liquidity needs by unlocking the value of your investments without selling them. This type of borrowing.

Secure a loan against a well-diversified portfolio, where possible. This lowers the chances of a margin call. The potential drawdowns on a diversified stock. wealth plan—balancing your short-term needs with long Initial Lending Value (ILV) is the maximum amount that could be borrowed against your portfolio. The term securities-based lending (SBL) refers to the practice of making loans using securities as collateral. Securities-based lending provides ready. Discover the “Buy, Borrow, Die” strategy: Buy an asset like stock & real estate, borrow against it at low-interest rates, and pass them on —tax-free — at death. They do this because selling stock is taxed, but loans aren't. And the interest payments on loans is far lower than the taxes due from a stock. The super-rich can unlock their wealth 'tax free' by taking out a loan secured against their shareholdings or other assets, then use the cash from the loan to. Secure a loan against a well-diversified portfolio, where possible. This lowers the chances of a margin call. The potential drawdowns on a diversified stock. wealth plan—balancing your short-term needs with long Initial Lending Value (ILV) is the maximum amount that could be borrowed against your portfolio. Simply put, borrowing on margin means taking an interest bearing loan secured by securities you own in your brokerage account (the securities are pledged as. You specify the investment account(s) from which you want to borrow money, and those investments are liquidated for the duration of the loan. Therefore, you. The interest, for those investing in publicly-traded securities, may also be tax deductible. One risk is an investment made from borrowed money may drop in. Simply put, borrowing on margin means taking an interest bearing loan secured by securities you own in your brokerage account (the securities are pledged as. A margin line allows investors to borrow up to 50% against the value of marketable securities held in their investment portfolio. The line can be used for. Borrow Against a Concentrated Stock Position: Supporting lifestyle spending without liquidating a large, concentrated stock position for tax purposes or other. A securities-based line of credit helps you to meet your liquidity needs by unlocking the value of your investments without selling them. This type of borrowing. If you're a more aggressive, growth-oriented investor, you can purchase more stock indices or mutual funds to seek a higher expected return. No matter your risk. Mutual of America offers retirement and investment solutions for employers of all sizes. Help your employees plan for the future. Learn more now! (I cannot borrow money to buy more stocks as this is against the rules.) The really wealthy got wealth because they received free stock shares in a. Flexible borrowing options with variable and fixed rate loan options such as lending against eligible securities in your Merrill investment account or the. They use a customized line of credit to create liquidity against various wealth holdings allowing them to act quickly on investment opportunities. A Private.

1 2 3 4 5